DETROIT, MI – Michigan commercial and tribal operators reported combined total internet gaming gross receipts and internet sports betting gross receipts of $187.3 million during January. Receipts fell 7.1% compared with December results of $201.6 million.

Internet gaming gross receipts for January were a Michigan record of $153.7 million. The previous internet gaming gross receipts monthly record of $152.8 million was set in December 2022. Internet gaming gross receipts rose a fractional 0.6% compared with December receipts.

Gross sports betting receipts were $33.6 million compared with $48.8 million reported in December for a 31.1% decrease.

Combined total adjusted internet gaming gross receipts and adjusted internet sports betting gross receipts were $156.17 million in January, falling 7.2% from December receipts of $168.23 million.

Internet gaming adjusted gross receipts at $138.32 million rose a fractional 0.6% from December’s $137.47 million. Monthly internet gaming adjusted gross receipts increased 26.7% compared with $109.18 million reported in January 2022.

Commercial and tribal operators reported a combined total of $17.85 million in internet sports betting adjusted gross receipts. This was a 42% decline from $30.76 million in receipts reported in December. Internet sports betting monthly adjusted gross receipts were down 6.9% compared with $19.17 million reported in January 2022.

Total handle at $475.6 million declined a fractional 0.7% from the $478.7 million total handle reported in December. Total handle was 4.3% lower than the January 2022 handle of $496.8 million.

January Taxes and Payments

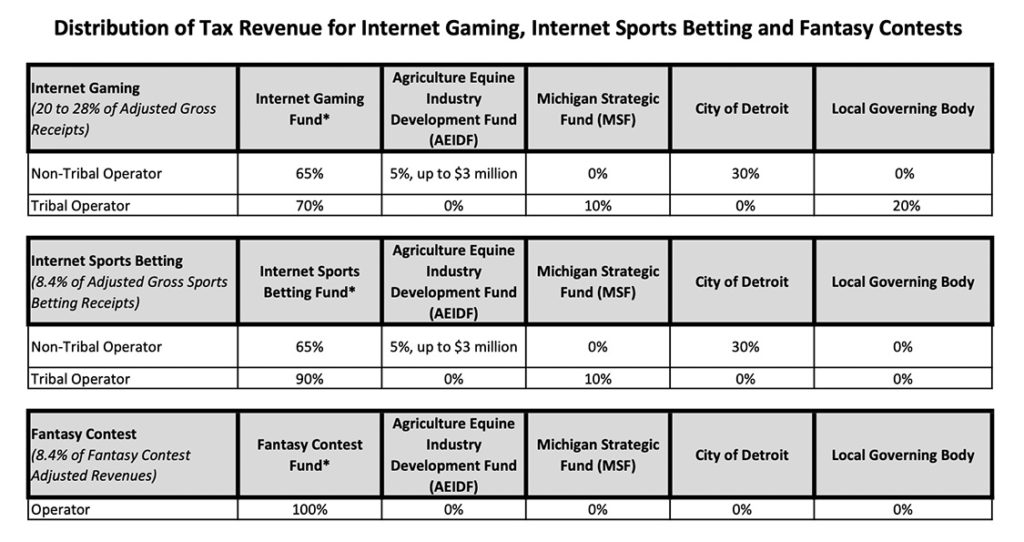

The operators delivered $26.1 million in taxes and payments to the State of Michigan in January including:

- Internet gaming taxes and payments: $24.9 million

- Internet sports betting taxes and payments: $1.2 million

The three Detroit casinos reported City of Detroit wagering taxes and municipal services fee payments of $7.5 million in January including:

- Internet gaming taxes and fees: $7 million

- Internet sports betting taxes and fees: $533,763

Tribal operators reported paying $2.7 million to governing bodies in January.

During January, a total of 14 operators offered internet gaming as one tribal operator ceased offering internet gaming during 2022. A total of 15 commercial and tribal operators offered internet sports betting.