UNCASVILLE, CT – Mohegan Tribal Gaming Authority has announced operating results for its second fiscal quarter ended March 31, 2025.

Second Quarter 2025 and Recent Highlights:

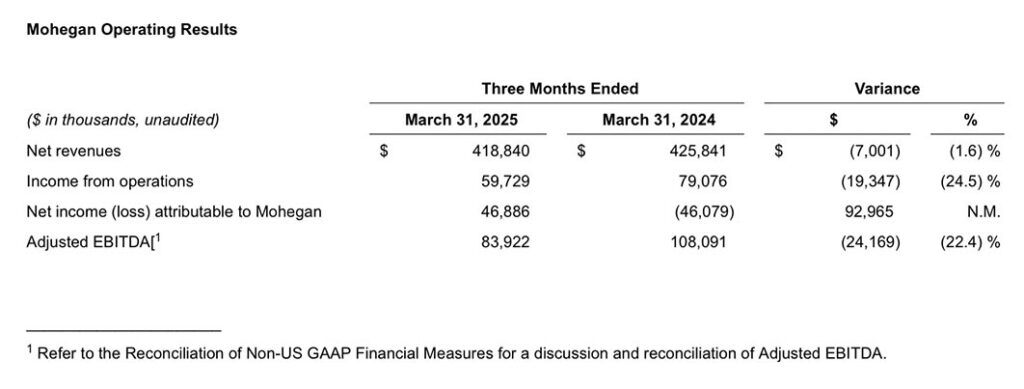

- Mohegan generated net revenues of $418.8 million.

- Mohegan Sun net revenues increased 4.1% year over year.

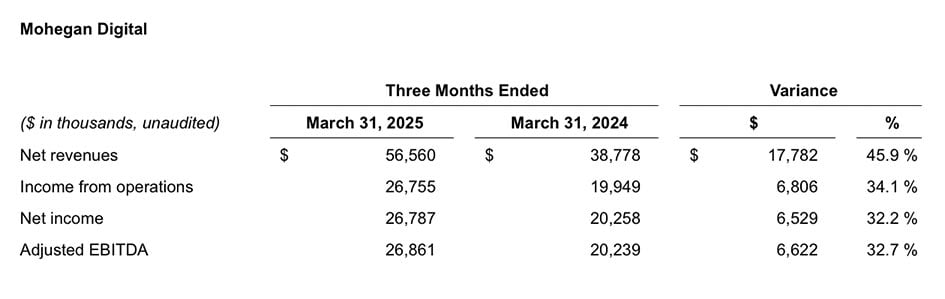

- Mohegan Digital Adjusted EBITDA increased 32.7% year over year.

- Completed comprehensive refinancing of substantially all of the Mohegan Restricted Group’s debt.

“During the quarter, we completed a holistic refinancing of our capital structure, which was among the most significant in our history,” said Raymond Pineault, CEO of Mohegan. “This important advancement was made possible through reconstituting our digital business into a commercial legal entity, which enabled us to unlock value for the company and investors, along with direct support from the tribe – all of which highlights the strategic importance of having the tribe as a long-term owner and investor. The culmination of these strategic initiatives has enabled us to build substantial runway and financial stability for the business which will allow us to remain hyper focused on our core business.”

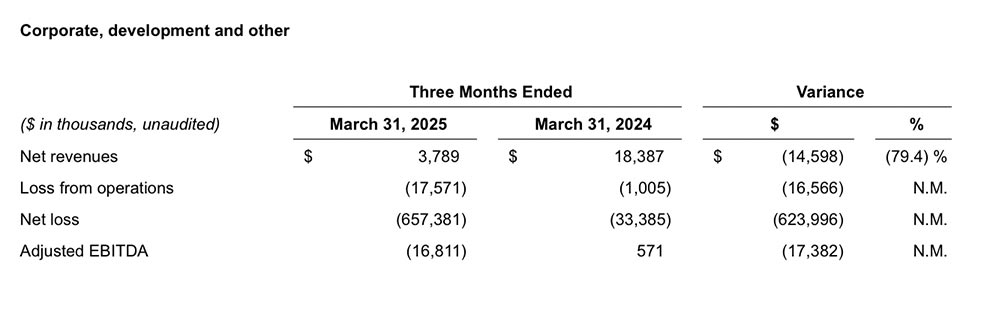

“Net revenues and adjusted EBITDA declined compared with the prior-year period, as the prior year benefited from ilani management fees, one-time non-cash license fee revenue at Mohegan Pennsylvania, and favorable economics in Niagara resulting principally from a notably stronger Canadian dollar,” said Ari Glazer, Chief Financial Officer of Mohegan. “Adjusted EBITDA was down $24.2 million or 22.4% compared with the prior-year, however after normalizing for ilani management fees and one-time adjustments, adjusted EBITDA would have been nearly flat on a same-store basis.”

Prior period amounts have been restated to exclude results of operations of Inspire Integrated Resort Co., Ltd. and its parent company MGE Korea Ltd. from continuing operations.

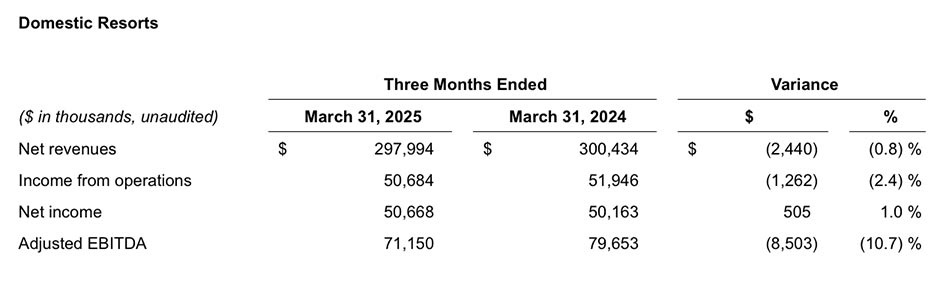

Net revenues of $298.0 million decreased $2.4 million compared with the prior-year period, primarily due to higher revenues in the prior year related to non-cash license fee revenues and online gaming revenues at Mohegan Pennsylvania, partially offset by growth at Mohegan Sun in the current period. Domestic Resorts’ gaming revenues decreased $10.4 million, or 5.0%, and non-gaming revenues increased $8.0 million, or 8.9%. The non-gaming growth was primarily attributed to increased food & beverage, hotel, and entertainment revenues in the period. Adjusted EBITDA of $71.2 million decreased $8.5 million primarily due to non-cash license fee revenues at Mohegan Pennsylvania in the prior-year period. Adjusted EBITDA margin of 23.9% was 263 bps unfavorable compared with the prior-year period.

Net revenues of $56.6 million increased $17.8 million compared with the prior-year period, as their Connecticut operations continue to outperform. Top-line growth from their Pennsylvania and Canada operations also contributed to the 45.9% year over year increase. Adjusted EBITDA of $26.9 million was $6.6 million, or 32.7% favorable compared with the prior-year period.

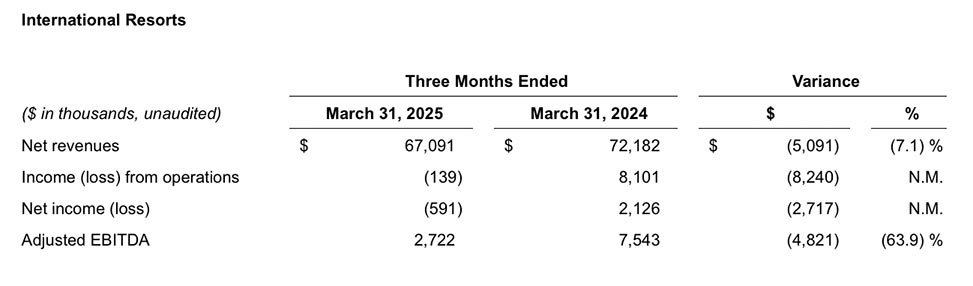

Net revenues of $67.1 million decreased $5.1 million compared with the prior-year period, primarily due to a stronger Canadian Dollar a year ago. Adjusted EBITDA of $2.7 million decreased $4.8 million, or 63.9% compared with the prior year. Current period adjusted EBITDA was adversely impacted by unfavorable currency exchange rates and changes in regulatory fees.

Liquidity

As of March 31, 2025 and September 30, 2024, Mohegan held cash and cash equivalents of $128.4 million and $145.7 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $194.7 million of borrowing capacity under its prior senior secured credit facility and line of credit as of March 31, 2025. In addition, inclusive of letters of credit, which reduce borrowing availability, Niagara Resorts had $34.9 million of borrowing capacity under its revolving credit and swingline facility as of March 31, 2025.