UNCASVILLE, CT – The Mohegan Tribal Gaming Authority has announced operating results for its third fiscal quarter ended June 30, 2025.

Third Quarter 2025 and Recent Highlights:

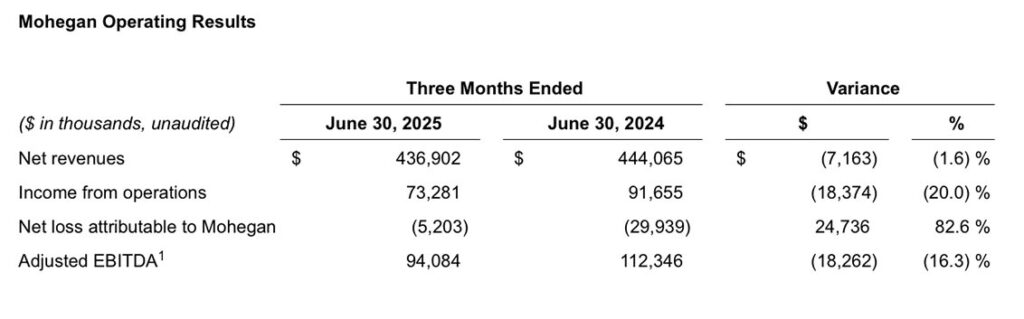

- Mohegan generated net revenues of $436.9 million.

- Mohegan Adjusted EBITDA, after normalizing the prior year period, increased 4.9% year over year.

- Mohegan Sun produced net revenues of $234.7 million.

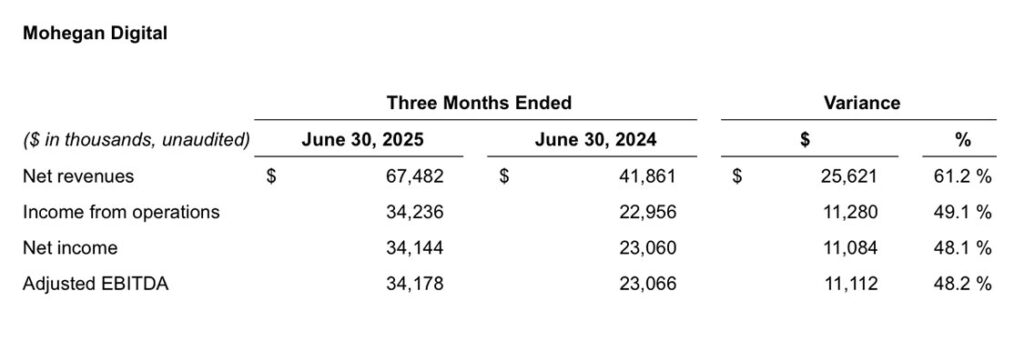

- Mohegan Digital Adjusted EBITDA increased 48.2% year over year.

“The completion of our comprehensive refinancing has placed us in a great position to continue executing our strategy, to be one of the premier omnichannel enterprises,” said Raymond Pineault, CEO of Mohegan. “This important milestone further supports our opportunities for long-term growth and the evolution of our digital business provides greater strategic flexibility. Now that we’ve addressed our capital structure, we’re singularly focused on executing our plan and increasing value for all our stakeholders.”

“Net revenues and Adjusted EBITDA declined compared with the prior-year period, as the prior year benefited from ilani management fees and one-time accelerated non-cash digital license fee revenue at Mohegan Pennsylvania,” said Ari Glazer, Chief Financial Officer of Mohegan. “Adjusted EBITDA was down $18.3 million or 16.3% compared with the prior year, however, after normalizing the prior year period for the ilani and Mohegan Pennsylvania adjustments, Adjusted EBITDA would have been up $4.4 million, or 4.9%.”

Prior period amounts have been restated to exclude results of operations of Inspire Integrated Resort Co., Ltd. and its parent company MGE Korea Limited from continuing operations.

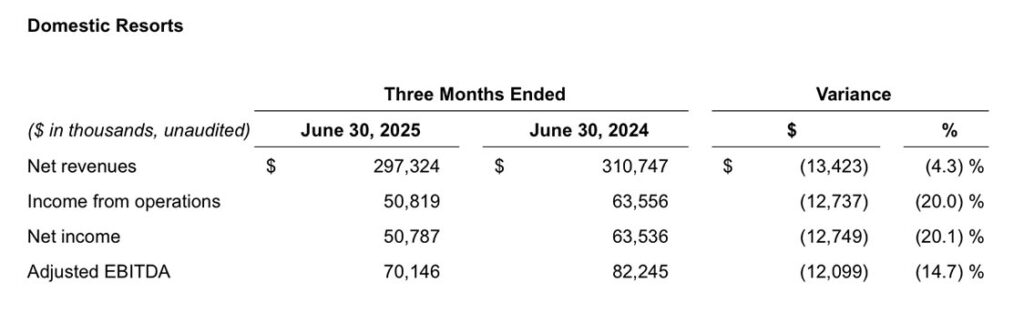

Net revenues of $297.3 million decreased $13.4 million compared with the prior year period, primarily due to higher revenues in the prior year related to one-time accelerated non-cash digital license fee revenue at Mohegan Pennsylvania and gaming revenues from Mohegan Casino Las Vegas. Domestic Resorts’ gaming revenues decreased $11.8 million, or 5.6%, and non-gaming revenues decreased $1.6 million, or 1.6%. Adjusted EBITDA of $70.1 million decreased $12.1 million primarily due to one-time accelerated non-cash digital license fee revenue at Mohegan Pennsylvania in the prior year period, and higher Mohegan Sun labor costs related to new food and beverage outlets in the current period. Adjusted EBITDA margin of 23.6% was 288 bps unfavorable compared with the prior year period.

Net revenues of $67.5 million increased $25.6 million, or 61.2% compared with the prior year period. The increase was primarily driven by their Connecticut operations, which continue to produce strong and profitable growth along with high player engagement. Their Pennsylvania and Ontario operations also achieved strong top-line growth from the comparable prior year period. Adjusted EBITDA of $34.2 million was $11.1 million, or 48.2% favorable compared with the prior year period.

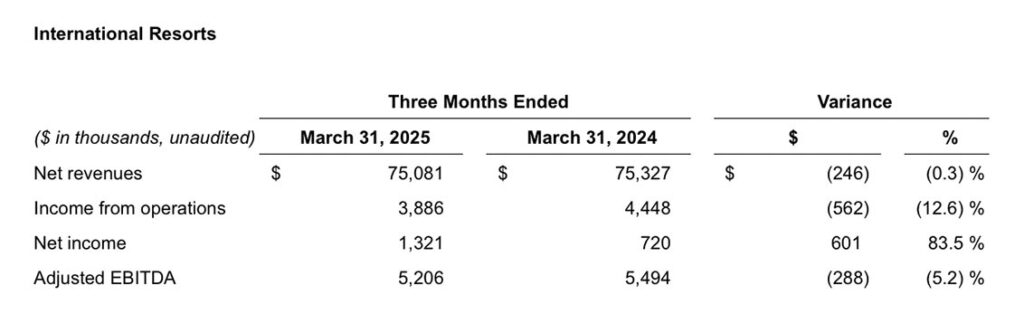

Net revenues of $75.1 million decreased $0.2 million compared with the prior year period. While gaming volumes grew year over year, net revenues, which are reported net of gaming taxes, were flat to the prior year period due to the return to higher pre-COVID gaming tax rates. Adjusted EBITDA of $5.2 million decreased $0.3 million, or 5.2% compared with the prior year.

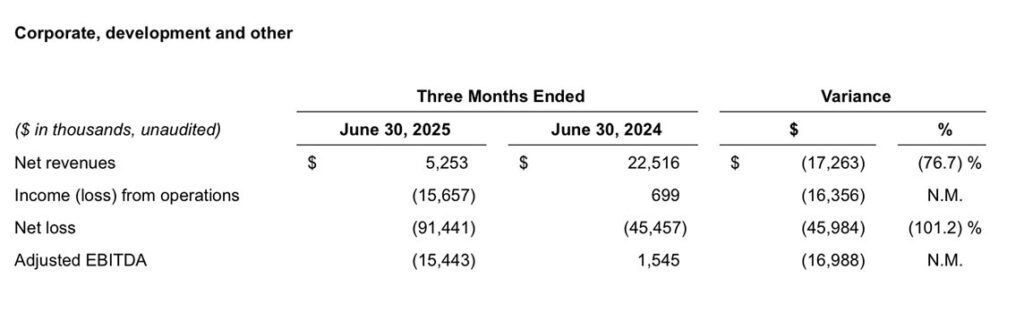

Adjusted EBITDA was $17.0 million unfavorable compared with the prior year period, primarily due to ilani management fees earned in the prior year.

Liquidity

As of June 30, 2025 and September 30, 2024, Mohegan held cash and cash equivalents of $145.2 million and $145.7 million, respectively. Inclusive of letters of credit which reduce borrowing availability, Mohegan had $141.4 million of borrowing capacity under its senior secured credit facility and line of credit as of June 30, 2025. In addition, inclusive of letters of credit which reduce borrowing availability, Niagara Resorts had $36.6 million of borrowing capacity under its revolving credit and swingline facility as of June 30, 2025.