by James M. Klas

Many things have changed in the post-COVID gaming industry and parking is one of them. There are many reasons for changing perspectives on parking. With the re-evaluation of space usage and food and beverage offerings, parking hogs like event centers and buffets are being scrutinized for true value and absolute size requirements. Casinos in general discovered the potential to generate as much or close to as much revenue from fewer customers. Staffing issues have sustained the motivation to try to maximize spend per customer rather than total customer count as there have simply not been enough staff available. All of these factors have combined to reduce the pressure on parking capacity to some degree.

At the same time, new ways to monetize parking have become available. In Las Vegas, most major strip casinos charge for parking. While they received significant pushback when the changes were first announced, most weathered the storm. The ability to have all parking fee transactions done by machines eliminated the need and cost for parking lot attendants, changing the value proposition. While not necessarily used at casinos, most parking meters in most cities now run on apps or credit card payment kiosks rather than from coins in the old-style meters. There is even a new company that has developed a customer pay app for premium parking spaces that has begun installations at Indian casinos. While fully pay-to-park lots and ramps are still a long way off for Indian gaming, if ever, there are at least some chances to mitigate the construction and maintenance costs of parking.

Of course, the biggest reason to make sure that parking capacity is suited not only to average days but to peak periods is the money that is generated by the customer in the casino once they have parked their vehicle. Sufficient parking is imperative to avoid the true loss of gaming revenue when customers cannot find a parking spot or do not come at all because they know that they will have trouble on peak nights. If you think about the average spend per customer per visit, especially for a higher-tier player, it takes very few visits lost to surpass the amount you would have to spend to add a parking space, even if it has to be in a ramp. The value proposition is surprisingly close to that of a slot machine.

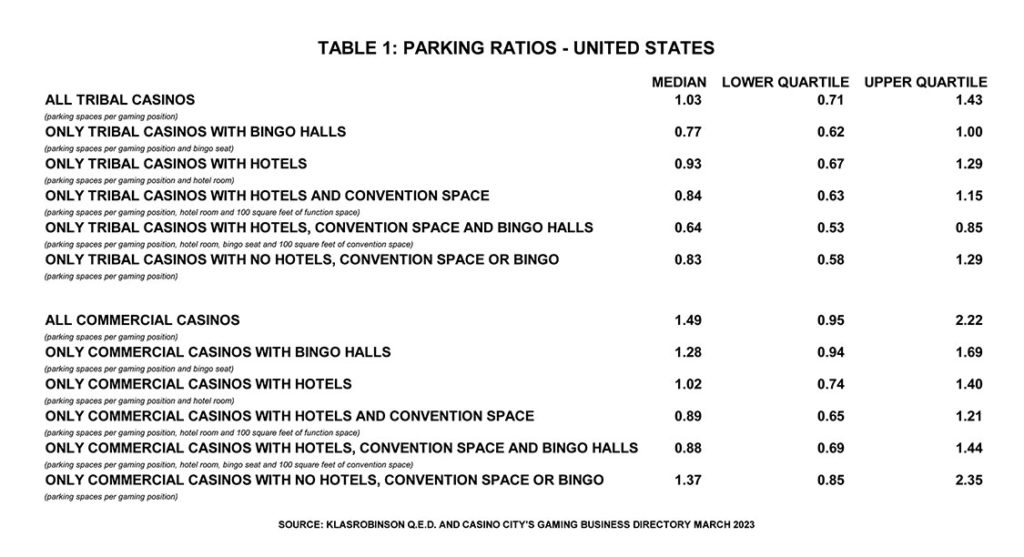

There are noticeable differences in the parking profiles of Indian casinos and those of commercial casinos. Using data from Casino City’s gaming directory, the medians and upper and lower quartiles for parking ratios at Indian casinos and at commercial casinos were examined and sorted by several different facility characteristics. The basic minimum is a casino alone, with no hotel, bingo hall or convention space. Adding a hotel, a bingo hall, and/or convention space adds to parking needs, both for added customers and added staffs.

Across all measurements and at all percentage breaks, commercial casinos consistently offer more parking for their patrons than Indian casinos. While the differences in some cases appear small, in other cases they are quite large. Also, for larger operations, even small differences in ratios add up to large total differences in available parking spaces when multiplied across all of the gaming positions, hotel rooms and convention square footage.

Table 1 shows the median and quartile statistics for all Indian and commercial casinos and for sub-categories depending upon what ancillary facilities and amenities they have. For each category, the relevant ratio is described below the line item. For all casinos in a classification (commercial or Indian) and for casinos without hotels, convention space or bingo, the measure is parking spaces per gaming position (tables count for seven positions). For casinos with bingo halls, the bingo seating is added to the gaming position count. For casinos with hotels, the room count is added to the gaming positions. For convention space, the ratio reflects the inclusion of each 100 sq. ft. of space.

The median number of parking spaces per gaming position for all Indian casinos is 1.03, versus 1.49 for commercial casinos. Translated to a casino with 1,000 gaming positions, that equates to a difference of 460 parking spaces. At 3,000 gaming positions, the difference is well over 1,000 spaces. At the top in terms of parking needs are casinos with hotels, convention space and bingo halls. For Indian casinos, the median parking ratio is 0.64, meaning that they have slightly less than one-third of a parking space for every gaming position, hotel room, bingo seat, and 100 sq. ft. of convention space, combined. For commercial casinos, the ratio is 0.88, roughly 38 percent higher. At the lower quartile, the gap is only slightly narrower at roughly 30 percent. However, at the upper quartile, commercial casinos offer over 69 percent more parking spaces than similar Indian casinos.

The mere fact that there are differences in actual parking ratios between Indian casinos and commercial casinos does not automatically mean that either sector is right and the other is wrong. Particularly in the post-COVID world, there are reasons to consider whether or not historic parking targets can be tweaked downward. However, at the simplest level, there is cause for concern that the Indian gaming sector is short changing itself at peak periods by undervaluing the importance of sufficient parking.

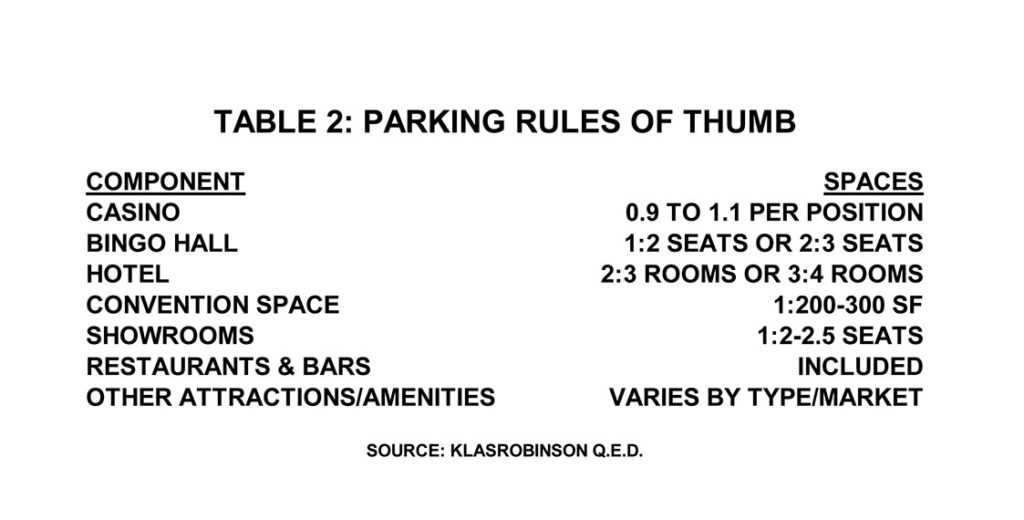

The ratios in Table 1 reflect only what is currently out there, not necessarily what should be. Table 2 shows rules of thumb to consider for suitable minimum amounts of parking. These are guidelines only. Each project and each site must be evaluated on its own merits and may require significant deviation from what would otherwise be considered “normal” due to unique conditions. Also, minimum, means minimum. Frequently, if not perhaps even the majority of the time, there are compelling reasons to build more than the minimum guidelines, even if it means more expensive structured parking.

For reference purposes, if you apply the guidelines in Table 2 to a casino with 2,000 gaming positions, a 500-seat bingo hall, 300 hotel rooms, 30,000 sq. ft. of convention space and a 1,500-seat showroom, you would end up with a parking ratio of approximately 0.73, which is more than the median for Indian casinos of that type, but less than the median for commercial casinos. If you work through the guidelines shown in Table 2 and find that your facility appears to be out of balance, or even if it does not, the real question is: just how full does your parking get and how often is it overflowing? If the answer is more than once a month or maybe even a half-a-dozen times per year, you should seriously consider increasing your capacity. At the same time, taking another look at monetizing at least some of your best parking spaces may help ease the cost of adding capacity or just improve your ancillary revenue stream even with no change at all.

James M. Klas is Co-Founder and Principal of KlasRobinson Q.E.D., a national consulting firm specializing in the economic impact and feasibility of casinos, hotels and other related ancillary developments in Indian Country. He can be reached by calling (800) 475-8140 or email jklas@klasrobinsonqed.com.