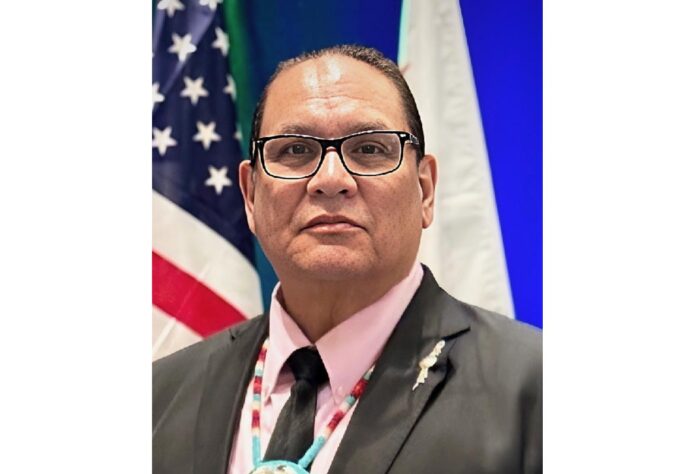

by Ernest L. Stevens, Jr.

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act into law. Thanks to a constant presence, a united voice, and strong relationships with key decision makers, Indian Country avoided the most potentially devastating impacts of the new law. However, continued vigilance is a must as the new law is eventually implemented.

The Big Bill consumed Congress for much of this year. Below is a short explanation of how it got to final passage and a broad overview of what is contained in the 870-page law.

The Reconciliation Process

In the wake of the 2024 elections, Republicans swept into power in January of 2025, retaining a slim majority in the U.S. House of Representatives and taking control of the U.S. Senate. On January 20, 2025, President Trump was sworn in to serve his second, albeit non-consecutive, term in office.

The new administration has taken unilateral action to propose and impose significant changes to the makeup of entire agencies, proposed realignments, and upheaval in the federal workforce. However, to make lasting change, the administration focused on the reconciliation process to enact a new law to codify the President’s campaign promises and policy goals.

Reconciliation is one of the few legislative procedures that allows congressional leaders to avoid the Senate’s filibuster and its 60-vote threshold, requiring only a simple majority vote in both the House and Senate. Essentially, no compromise is required.

Recent examples of reconciliation bills include former President Biden’s Inflation Reduction Act of 2022, the COVID-related American Rescue Plan Act of 2021, President Trump’s Tax Cuts and Jobs Act of 2017, and President Obama’s Affordable Care Act of 2010.

Shortly after his inauguration, President Trump directed Congress to use the reconciliation process to enact a single package, which he deemed the “One Big Beautiful Bill,” that would accomplish his stated goals. These goals include extending the Tax Cuts and Jobs Act of 2017, eliminating taxes on tips, enacting additional tax measures, and providing mandatory spending increases for immigration and border enforcement, defense, and energy policy – particularly through expanded oil, gas, and mining production.

After much back and forth between the House and the Senate, Congress passed the sweeping reconciliation package, and President Trump signed it into law on July 4th. The law includes a permanent extension of the 2017 tax cuts and time-limited cuts to taxes on tips and other measures that come to an approximate cost of $4 trillion to the Treasury. It includes $150 billion in funding to complete construction of the border wall and to enhance immigration enforcement. And it includes approximately $150 billion in defense spending, including $25 billion to begin construction of a “Golden Dome,” among many other measures.

To offset some of this spending, the new law proposes nearly $1 trillion in cuts to Medicaid by imposing work requirements for certain individuals. Similar work requirements are imposed on low-income earners who rely on the Supplemental Nutrition Assistance Program (SNAP), which purportedly will save nearly $300 billion. In addition, the new law repeals nearly $500 billion in renewable energy programs and tax credits that former President Biden signed into law with the Inflation Reduction Act.

In the end, the Congressional Budget Office estimates that the law will increase the budget deficit by more than $2.5 trillion over the next ten years.

Indian Country was well-informed heading into this process. In January of this year, the Indian Gaming Association and dozens of national and regional tribal organizations formed the Coalition for Tribal Sovereignty to bring a united voice to educate policy makers.

The Coalition engaged early in the reconciliation process, raising concerns about the impacts on Indian healthcare from proposed cuts to the health safety net programs. The obligation to provide for Indian healthcare is the most fundamental of the federal government’s treaty and trust obligations to Indian tribes. Medicaid funding represents 30-60% of the annual budget for many individual tribal healthcare systems, and any cuts to Medicaid would cripple Indian healthcare services.

Thanks to this early outreach, the One Big Beautiful Bill Act includes a broad exemption from the new Medicaid work requirements for all individuals eligible to receive health care from the Indian Health Service. A similar broad exemption for Native Americans was included in the final bill for purposes of the SNAP work requirements.

The new law also includes a long-sought tax parity provision for Indian Country. The law amends the tax code to extend the federal child adoption tax credit to families who adopt a child with special needs where the adoption is approved by a tribal court. Prior to this change, access to the federal child adoption tax credit was only extended to adoptions approved in state courts.

While tribes nationwide applaud these provisions, many remain concerned about potential collateral impacts from the new law as it gets implemented. Cuts to Medicaid could harm rural hospitals, forcing many to close, which would adversely impact the ability of individuals to receive certain critical health services. The new work requirements to Medicaid and SNAP are set to go into effect on December 31, 2026.

For the gaming industry, the initial House-passed version of the One Big Beautiful Bill – passed in late June – included a clean extension of the tax provision that permits gamblers to deduct 100% of their losses from their winnings. However, the Senate version, which was signed into law, slipped in an amendment to the tax extension that permits gamblers to deduct only 90% of their losses from their winnings. A bill has already been introduced in Congress to reverse this change and restore the full deduction, but that bill will need bipartisan support to gain traction.

Indian Country will continue to monitor the reconciliation package as it is implemented in the coming months and years. But we have much more work to accomplish this year. Tribes nationwide are closely monitoring the work of the Commodities Futures Trading Commission (CFTC) and its potential impacts on the Indian gaming industry. In addition, the President’s FY 2026 budget proposes steep cuts to programs at the Bureau of Indian Affairs, Bureau of Indian Education, the Housing Department, and many others.

To meet these challenges, we must continue to stand united in a strong presence and a united front.

Ernest L. Stevens, Jr. is Chairman of the Indian Gaming Association. He can be reached by calling (202) 546-7711 or visit www.indiangaming.org.