by James M. Klas

Indian casinos posted their customary annual new record in 2024 reaching $43.9 billion in gross gaming revenue, according to data published by the National Indian Gaming Commission. That total represents an increase of 4.6 percent from 2023, a particularly encouraging result given that revenue growth depends more and more on year-to-year changes at existing casinos versus new openings.

The growth in revenue was even more impressive in the Oklahoma City and Washington D.C. regions, with both reaching double digits. In terms of actual dollars, the D.C. region had by far the highest growth, increasing by over $1.0 billion from last year, more than two and one-half times as much as the next closest region, Oklahoma City, at approximately $408.2 million. Every region saw an increase from 2023. The lowest growth on a percentage basis occurred in the Tulsa region at only 0.1 percent, with the Sacramento region showing a 1.4 percent year-over-year increase. Tulsa had the lowest total dollar growth as well, even lower than Rapid City, perennially the smallest region in terms of total revenue and usually the lowest in terms of dollar growth. After two years of leading the pack in revenue growth, the Phoenix region experienced much more modest increases in 2024 at $73.6 million and 1.9 percent respectively.

The NIGC received audited financial statements for 532 properties for 2024, an increase of five properties from 2023. Regions with increased properties reporting included D.C. (+1), Oklahoma City (+3), Portland (+2), and St. Paul (+2). Three regions had fewer properties reporting, Tulsa (-1), Phoenix (-1) and Rapid City (-1). Sacramento had the same number of properties reporting as last year.

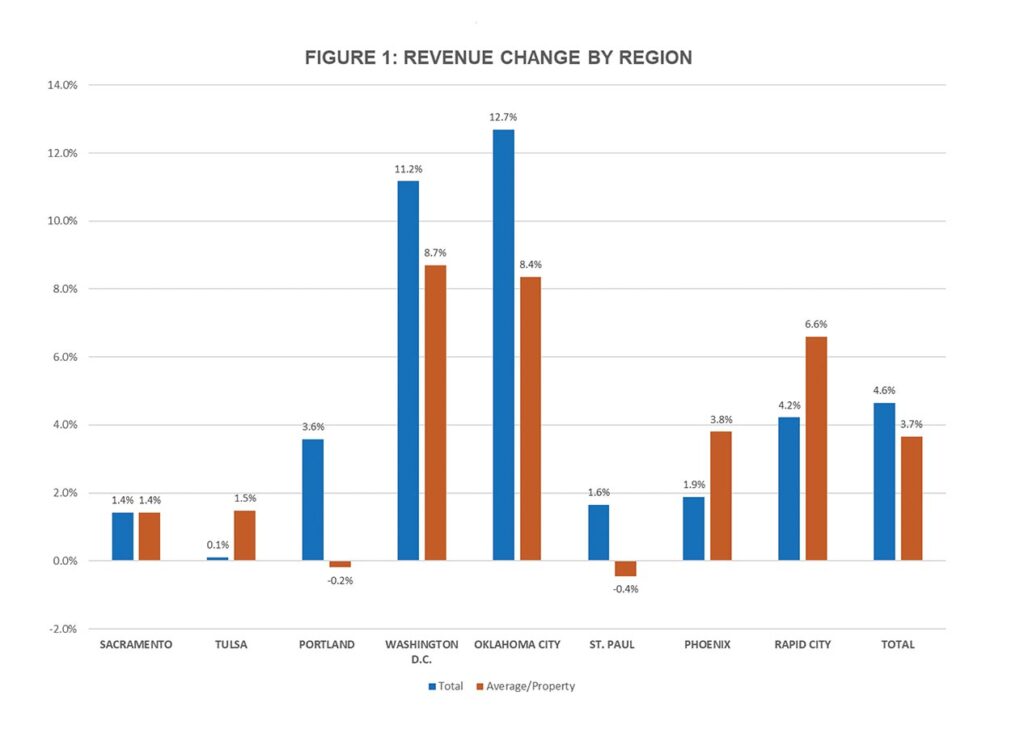

Taking into account the changes in the numbers of properties reporting, year-to-year average gaming win per property by region presents a more mixed picture than the overall increases regionwide described above. The D.C. region and the Oklahoma City region still led the way in average revenue per property growth with 8.7 percent and 8.4 percent respectively. Rapid City also showed a healthy increase in average revenue per property at 6.6 percent. Two regions, St. Paul and Portland, experienced declines in average revenue per property of 0.4 percent and 0.2 percent respectively. Nationwide, the growth in average gaming win per property was 3.7 percent. Figure 1 shows the percentage changes in total gaming revenue and average per property by region from 2023 to 2024.

Figure 1

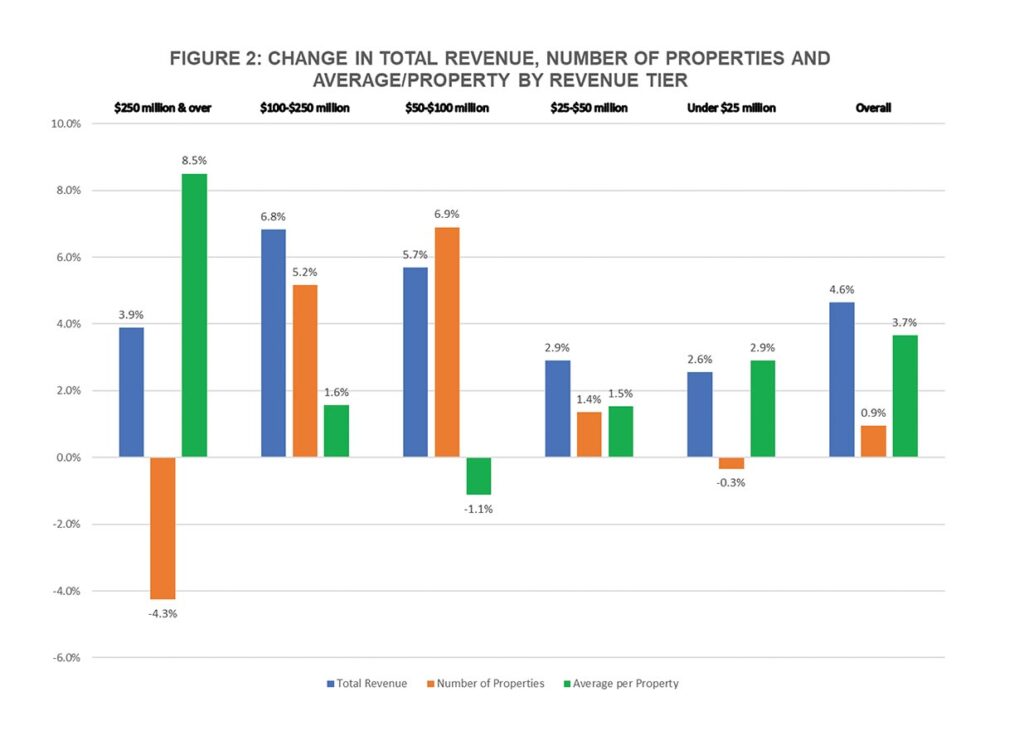

The NIGC also provides information on industrywide performance by gaming revenue bracket. The top revenue bracket, $250 million or more, showed an increase of 3.9 percent in total gaming revenue over 2023, despite a decrease in the number of properties in that bracket of 4.3 percent. The next bracket down, $100-$250 million, had the greatest increase in total gaming revenue of 6.8 percent, but an average per property that increased only 1.6 percent. The reason for the inconsistencies in the top two categories is a movement of some of the lowest performing properties in 2023 in the over $250 million bracket back below the $100-$250 million threshold in 2024 and into the lower bracket. Indeed, the over $250 million bracket was one of only two brackets to lose properties, going from 47 in 2023 to 45 in 2023. Figure 2 shows year-over-year changes by gaming revenue tier.

Figure 2

The tariff policies of the current administration remain as erratic as ever. However, a pattern is emerging that, at least through the first two-thirds of this year, has led to less severe impacts on inflation than many have feared. While it is still imprudent to make a long-term prediction on tariff policy, the tendency so far has been to threaten for negotiating purposes and then back off when new concessions are extracted. If that pattern continues, the inflationary pressure from tariffs may be less severe. Given the end of Chairman Powell’s term in May of next year and the decidedly mixed indications of economic health from other relevant measures, it seems more possible that interest rate targets will finally be reduced over the next 16 months, although by how far is anyone’s guess.

For planning purposes for the remainder of this year and looking ahead into 2026, it is anticipated the industry as a whole will maintain a slow to modest growth pattern, somewhere between the last two years plus or minus half a percentage point. For individual properties, local competitive and economic factors will continue to outweigh national and global impacts.

James M. Klas is Co-Founder and Principal of KlasRobinson Q.E.D., a national consulting firm specializing in the economic impact and feasibility of casinos, hotels and other related ancillary developments in Indian Country. He can be reached by calling (800) 475-8140 or email [email protected].