UNCASVILLE, CT – Mohegan Tribal Gaming Authority has announced operating results for its second fiscal quarter ended March 31, 2024.

Second Quarter 2024 and Recent Highlights:

- Mohegan achieved its highest quarterly net revenue in our history, up 13.8% year over year.

- Mohegan INSPIRE celebrated its official grand opening on March 5 and earned a prestigious five-star hotel rating.

- Mohegan Digital launched in Pennsylvania on April 2, as they continue to expand their online gaming presence and grow brand recognition to complement their land-based operations.

- Mohegan successfully implemented a new global Enterprise Resource Planning system, on April 1, to unlock operating efficiencies, which support Mohegan’s growth and transformation into a premier global integrated resort operator.

“These important milestones are vital to the foundation we’re building to ensure our continued success as we build for 13 generations to come, and beyond,” said Raymond Pineault, Chief Executive Officer of Mohegan. “As we work towards our objectives, these recent achievements demonstrate the effectiveness of our strategy to support our transformation into a world renown global resort operator.”

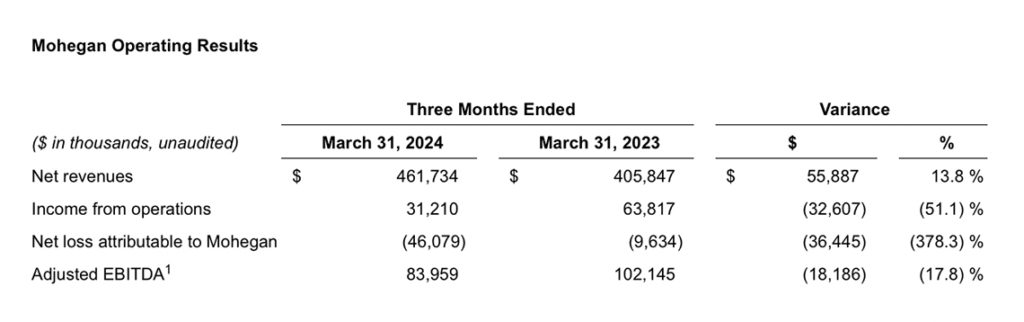

“Net revenues of $461.7 million increased $55.9 million compared with the prior-year period, primarily due to continued growth in Mohegan Digital and revenue from Mohegan INSPIRE,” said Ari Glazer, Chief Financial Officer of Mohegan. “Consolidated Adjusted EBITDA of $84.0 million decreased $18.2 million compared with the prior-year period, primarily due to operating costs related to the opening of Mohegan INSPIRE and non-controlling interest adjustments at Niagara Resorts.”

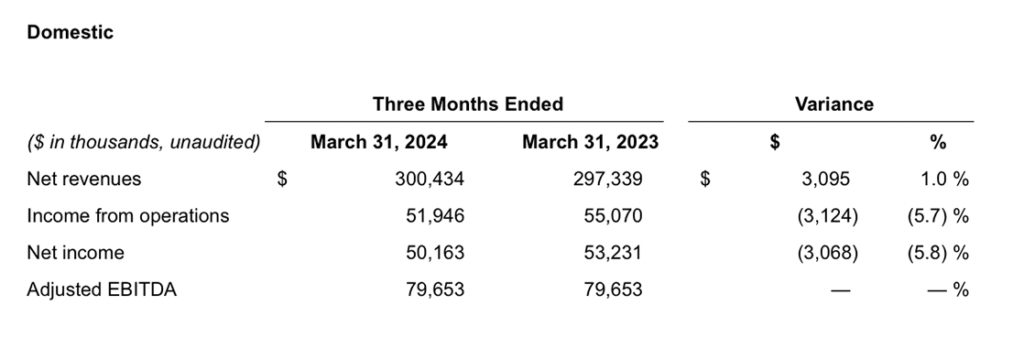

Net revenues of $300.4 million increased $3.1 million compared with the prior-year period, primarily due to higher non-gaming revenues. The non-gaming growth was driven by strong entertainment, food and beverage revenues in the period. Adjusted EBITDA of $79.7 million and Adjusted EBITDA margin of 26.5% were flat compared with the prior-year period.

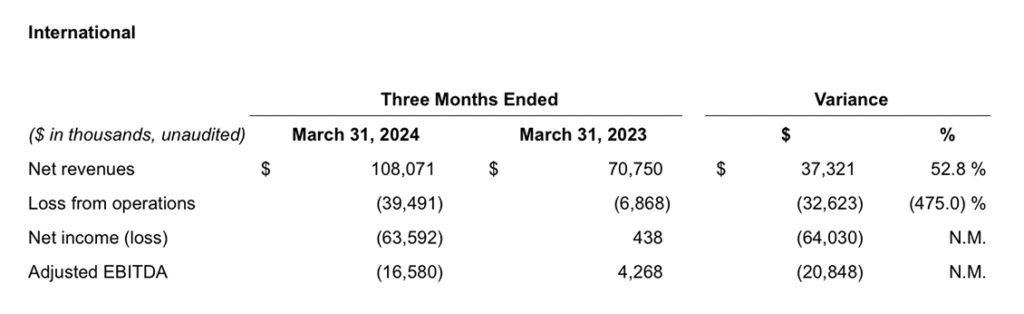

Net revenues of $108.1 million increased $37.3 million compared with the prior-year period, primarily driven by Mohegan INSPIRE. Adjusted EBITDA loss of $16.6 million was unfavorable, primarily due to operating costs related to the opening of Mohegan INSPIRE and a $5.0 million non-controlling interest adjustment related to Niagara Resorts. Excluding the adjustment for non-controlling interest, Adjusted EBITDA loss would have been $11.6 million, which we believe presents a more accurate comparison with prior periods.

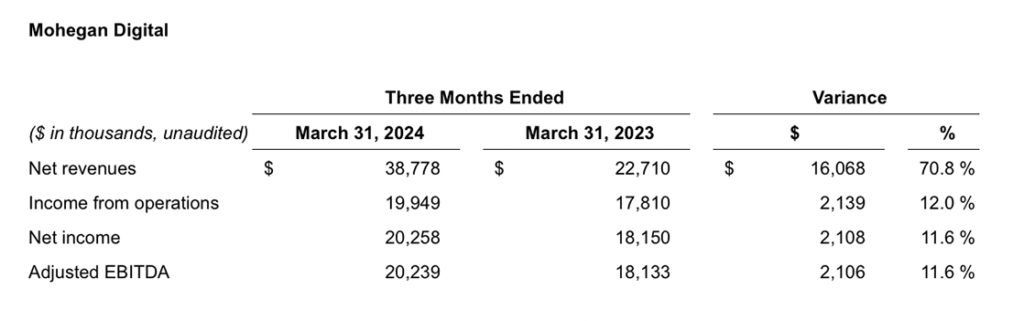

Net revenues of $38.8 million increased $16.1 million compared with the prior-year period, partially due to $8.8 million in iGaming tax reimbursements from our iGaming partners being included as an increase to both net revenues and expenses in the current year. Adjusted EBITDA of $20.2 million was $2.1 million favorable compared with the prior-year period, as Mohegan Digital continues to experience strong growth.

In addition, Mohegan Digital’s prior-year results include a favorable one-time adjustment related to the revenue share allocation from our digital gaming partner.

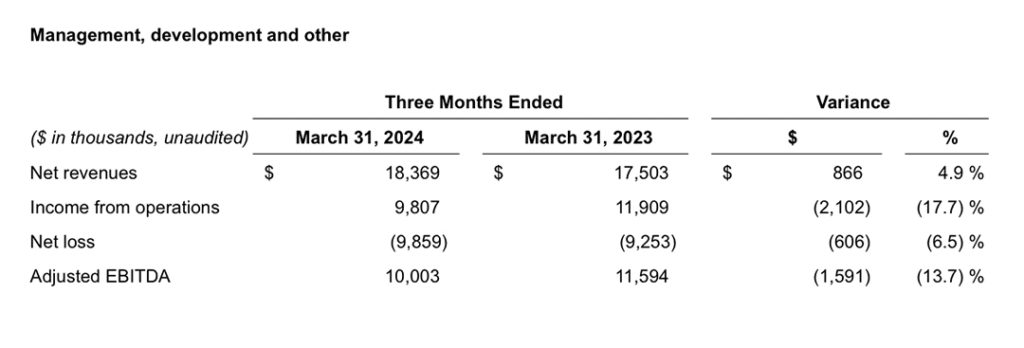

Net revenues of $18.4 million increased $0.9 million compared with the prior-year period, primarily due to inter-company entertainment revenue of $3.1 million, which was partially offset by Mohegan INSPIRE development fees earned in the prior-year period. Adjusted EBITDA of $10.0 million was $1.6 million unfavorable compared with the prior-year period.

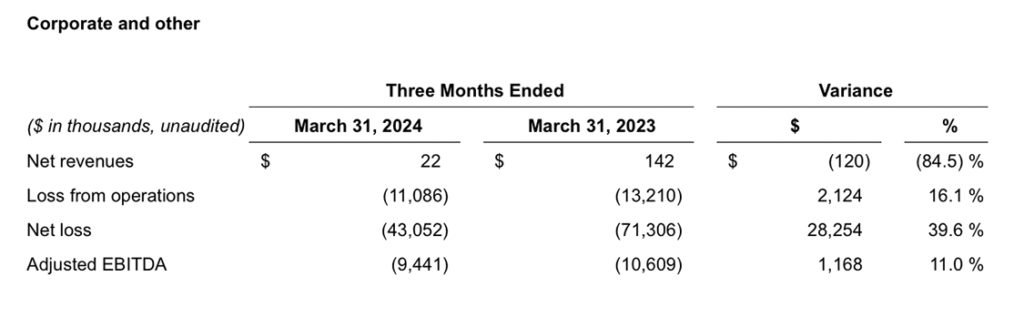

Adjusted EBITDA was $1.2 million favorable compared with the prior-year period, primarily due to corporate labor savings. Net loss was $28.3 million favorable compared with the prior-year period, primarily due to a gain on fair value adjustment driven by changes in the estimated value of the warrants and put option related to our Korea Term Loan.

Other Information:

Liquidity

As of March 31, 2024 and September 30, 2023, Mohegan held cash and cash equivalents of $197.8 million and $217.3 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $145.6 million of borrowing capacity under its senior secured credit facility and line of credit as of March 31, 2024. In addition, inclusive of letters of credit, which reduce borrowing availability, Niagara Resorts had $36.9 million of borrowing capacity under its revolving credit and swingline facility as of March 31, 2024.