UNCASVILLE, CT – Mohegan Tribal Gaming Authority recently announced operating results for its first fiscal quarter ended December 31, 2022.

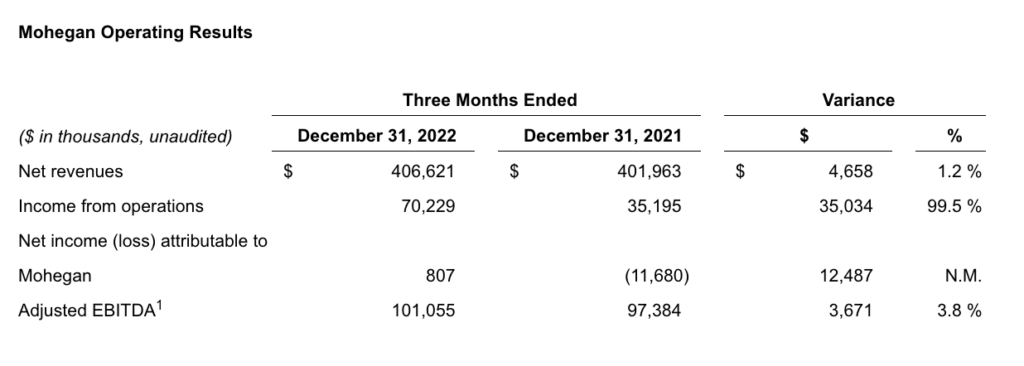

“Our consolidated Adjusted EBITDA of $101.1 million continues our trend of strong performance,” said Raymond Pineault, Chief Executive Officer of Mohegan. “Our diversification strategy and continued focus on profitability have enabled Mohegan to offset some of the inflationary and labor pressures and achieve these strong results.”

Carol Anderson, Chief Financial Officer of Mohegan, also noted, “Our Adjusted EBITDA margin of 24.9% was 605 basis points favorable compared with our pre-COVID-19 first quarter of fiscal 2020 and 62 basis points favorable compared with the prior-year period.”

The growth in net revenues compared with the prior-year period was primarily driven by a full period of operations and a return to relatively normal operating conditions at the Niagara Resorts, combined with the continued growth in our online casino gaming and sports wagering operations in Connecticut.

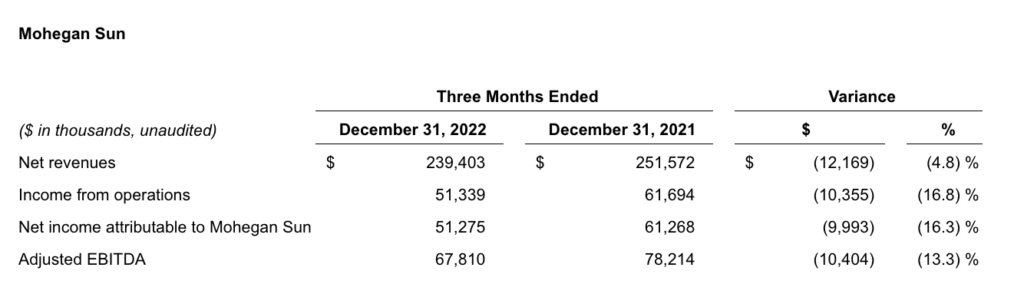

Net revenues decreased $12.2 million compared with the prior-year period due to declines in both slot and table games revenues, reflecting lower overall volumes as the prior-year benefited from Mohegan Sun’s 25th anniversary celebration. Results were also impacted by unfavorable slot and table hold and weather in the current-year period. Adjusted EBITDA of $67.8 million was 13.3% unfavorable compared with the prior-year period, due to lower volumes and increased labor and other operating expenses in the current-year period. The Adjusted EBITDA margin of 28.3% was 150 basis points favorable compared with our pre-COVID-19 first quarter of fiscal 2020, but 277 basis points unfavorable compared with the prior-year period.

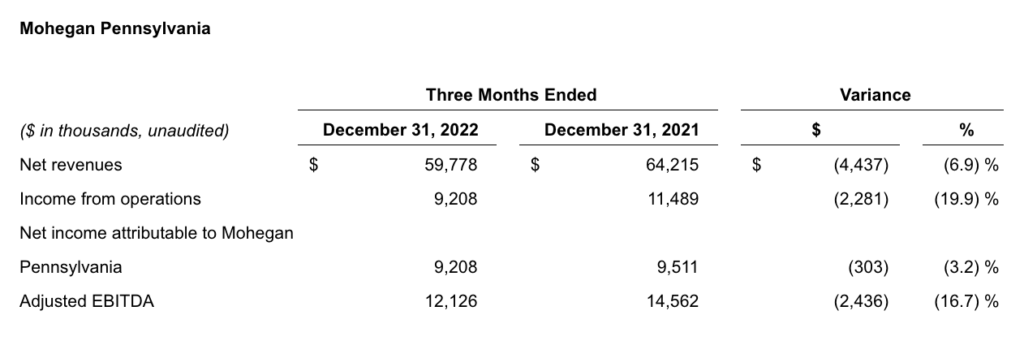

Net revenues decreased $4.4 million compared with the prior-year period primarily due to lower gaming revenues as a result of lower gaming volumes that were impacted by poor weather and table games hold percentage. Adjusted EBITDA decreased $2.4 million, or 16.7%, compared with the prior-year period, primarily due to the decrease in net revenues. Adjusted EBITDA margin of 20.3% was 220 basis points favorable compared with our pre-COVID-19 first quarter fiscal 2020, but 239 basis points unfavorable compared with the prior-year period.

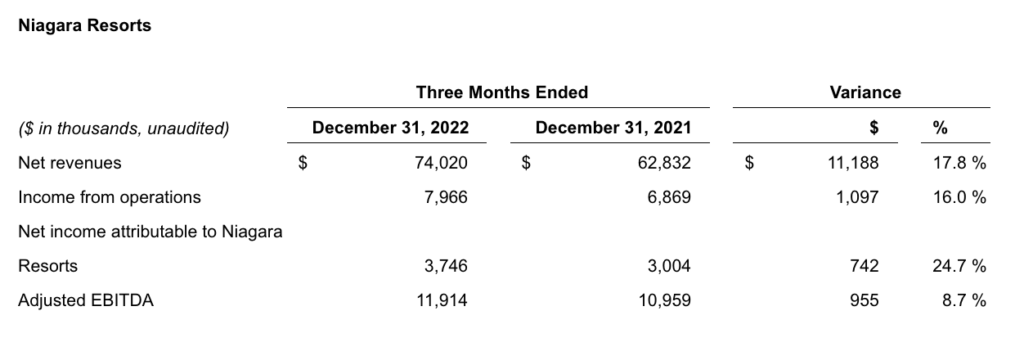

Net revenues increased $11.2 million compared with the prior-year period due to higher gaming volumes and a substantial increase in non-gaming revenues. These results reflect increased volumes related to the opening of the 5,000 seat OLG Stage entertainment venue and the properties operating without various COVID-19 related restrictions in the current year. Adjusted EBITDA increased $1.0 million or 8.7%. Adjusted EBITDA margin of 16.1% was 1,160 basis points favorable compared with our pre-COVID-19 first quarter of fiscal 2020, but 134 basis points unfavorable compared with the prior-year period due to the continued reintroduction of certain lower margin non-gaming amenities, as well as increased labor, marketing and other operating costs.

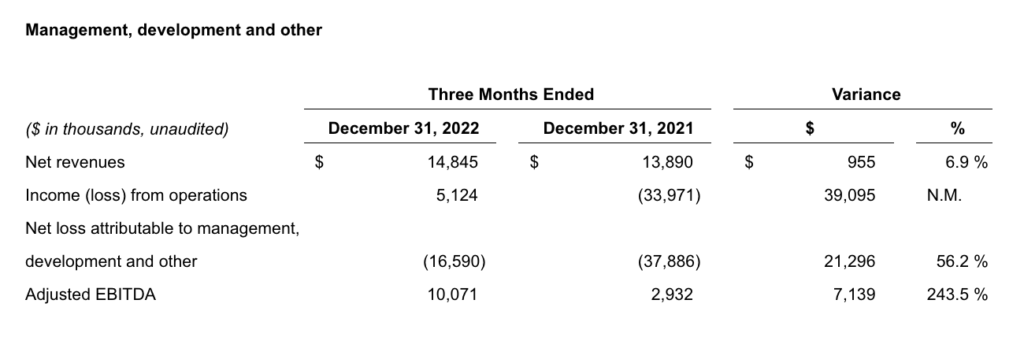

Adjusted EBITDA of $10.1 million was 243.5% favorable compared with the prior-year period, primarily due to certain debt issuance costs that were expensed in connection with Mohegan INSPIRE in the prior year. Net loss for the period was $21.3 million favorable compared with the prior-year period primarily resulting from $30.5 million in non-recurring impairment charges related to Mohegan INSPIRE in the prior-year period.

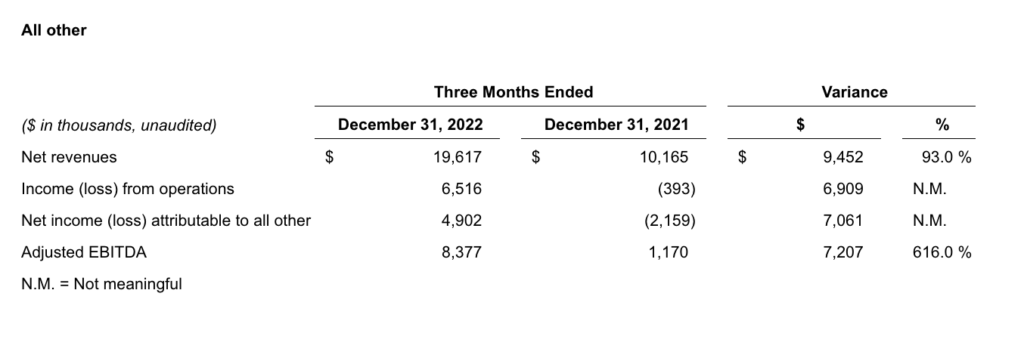

Adjusted EBITDA of $8.4 million was $7.2 million or 616.0% favorable compared with the prior-year period, primarily due to the continued growth in our online casino gaming and sports wagering operations in Connecticut which commenced in October of last year.

Liquidity

As of December 31, 2022 and September 30, 2022, Mohegan held cash and cash equivalents of $179.6 million and $164.7 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $228.9 million of borrowing capacity under its senior secured credit facility and line of credit as of December 31, 2022. In addition, inclusive of letters of credit, which reduce borrowing availability, the Niagara Resorts had $121.8 million of borrowing capacity under the Niagara Resorts revolving credit facility and swingline facility as of December 31, 2022.