LAS VEGAS, NV – Everi Holdings (NYSE: EVRI) has announced results for the first quarter ended March 31, 2023.

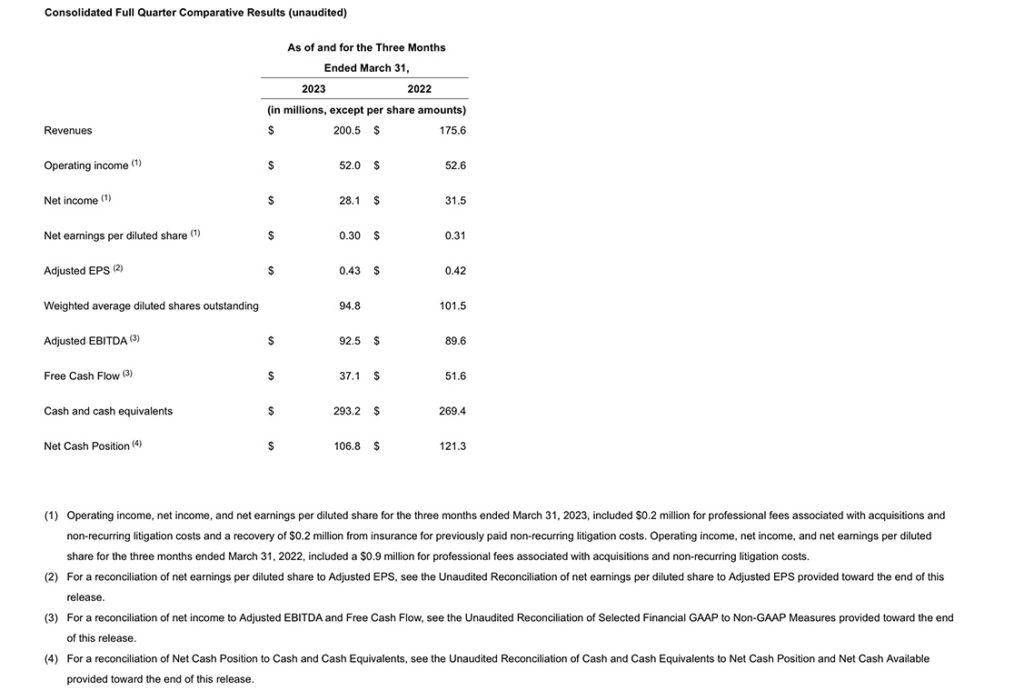

Revenues for the three-month period ended March 31, 2023 increased 14% to $200.5 million compared to $175.6 million in the year-ago quarter. Organic revenues increased 10%, or $18.2 million, while revenues from acquisitions completed in 2022 contributed $6.7 million, or 4%, of the year-over-year growth. Recurring revenues increased 11% to $148.9 million from $134.4 million in the prior-year period driven by growth in both the games and FinTech segments. Revenues from one-time sales grew 25% to $51.6 million from $41.2 million a year ago, primarily driven by a 34% increase in FinTech hardware sales and a 15% increase in gaming equipment sales.

Operating income of $52 million was essentially flat with $52.6 million in the prior-year period. The year-over-year increases in operating expenses, research and development expense, and amortization and depreciation largely reflect the impact of acquisitions completed in 2022, as well as higher development costs to support the company’s growth initiatives. The change in revenue mix, arising from more rapid growth in one-time product sales, contributed to a lower operating margin compared to the same period a year ago.

Primarily reflecting a $6.6 million increase in net interest expense partially offset by a lower provision for income tax, net income was $28.1 million, or $0.30 per diluted share, compared to $31.5 million, or $0.31 per diluted share, in the first quarter of 2022.

Higher interest expense offset by a lower provision for income tax and fewer weighted average diluted shares outstanding resulted in adjusted EPS of $0.43 per diluted share compared with $0.42 per diluted share in the prior year.

Adjusted EBITDA increased 3% to $92.5 million from $89.6 million in the prior-year period, inclusive of the impact of $3.6 million in higher development costs to support future growth.

Free cash flow was $37.1 million compared with $51.6 million in the year-ago period, primarily reflecting $10.6 million in higher net cash interest paid and an increase in discrete capital expenditures.

“Overall, our first quarter results continued to demonstrate our consistent growth profile, as we further execute on our organic growth initiatives and benefit from several acquisitions we completed over the last 12 months,” said Randy Taylor, Chief Executive Officer of Everi. “As a result and despite the uncertainty of the macroeconomic environment and higher interest rates, we continue to be favorably positioned to deliver solid top-line growth that we expect will generate at least $92 million of net income and at least $150 million in free cash flow this year.”

“Revenues for our games segment rose 9% year over year, reflecting a 15% increase in our gaming equipment revenues in the quarter even, as expected, customer demand slowed ahead of the launch of our new Dynasty VueTM cabinet. Customer deliveries of this new cabinet began on schedule and early customer and player feedback has been encouraging, as we are seeing strong initial demand. Dynasty Vue is just the first of several new cabinets in our pipeline, as we expect to showcase two new premium, lease-specific cabinets on the Dynasty platform this summer. We expect our expanded cabinet offering combined with the increase in our game content and our ability to address a growing number of market opportunities, such as historical horse racing machines, will help us progress toward our longer-term goal of 15% unit ship share.”

“In our FinTech segment, we achieved another quarter of strong double-digit growth in revenue, operating income and adjusted EBITDA. Solid same-store growth in transactional activity led to player funding that exceeded $11 billion on a quarterly basis for the first time and drove revenue growth in financial access services. This growth, combined with even higher growth in hardware and software and other revenues, helped drive an all-time quarterly record in FinTech revenues.”

“Our financial results continue to benefit from our capital allocation priorities, including our focus on high-value internal product development efforts and our ability to execute on strategic tuck-in acquisitions for businesses that we expect to scale and optimize, such as our recent acquisition of the assets of Video King, a leading provider of integrated electronic bingo gaming tablets and systems, that closed on May 1. With our anticipated strong free cash flow generation, we expect to continue returning capital to our shareholders through our increased share repurchase program, while we focus on integrating recent acquisitions that provide incremental growth opportunities in 2023 and beyond.”

2023 First Quarter Games Segment Highlights

Games segment revenues increased 9% to $107.4 million compared to $98.3 million in the first quarter of 2022, reflecting a 15% increase in revenues from gaming equipment sales and a 7% increase in gaming operations revenues, inclusive of digital gaming operations. The acquisition of Intuicode Gaming contributed $3.1 million in revenues in the 2023 first quarter.

Operating income was $22.3 million compared to $27.8 million in the first quarter of 2022, reflecting higher operating expenses primarily due to higher labor costs, as well as increased depreciation and amortization associated with acquisitions, and higher research and development expense reflecting an increased investment in games development and engineering costs. Adjusted EBITDA was $53.7 million compared with $55.5 million in the first quarter of 2022.

Gaming operations revenues increased 7% to $75.3 million compared to $70.3 million a year ago.

- The installed base expanded by 3%, or by 513 units, year over year, and decreased by 134 units on a quarterly sequential basis. The premium portion of the installed base represented 49% of the installed base at period end compared to 47% a year ago and, as expected, was essentially flat on a quarterly sequential basis.

- Daily Win per Unit (DWPU) was $38.37 in the first quarter of 2023 compared to $39.76 in the first quarter of 2022 and increased from $37.76 on a quarterly sequential basis.

- Revenues from digital gaming rose 18% to $6.5 million compared to $5.5 million in the first quarter of 2022. The increase primarily reflects growth in the library of available slot content. Subsequent to quarter-end, Everi’s content went live in Alberta, Canada on the provincial-wide PlayAlberta™ gaming platform operated by the Alberta Gaming and Liquor Commission.

- Gaming equipment and systems revenues generated from the sale of gaming machines and other related parts and equipment, increased 15% to $32.1 million compared to $28.0 million in the first quarter of 2022.

- The company sold 1,546 gaming machines at an average selling price (ASP) of $19,748 in the 2023 first quarter, compared with 1,474 units sold at an ASP of $18,157 in the 2022 first quarter. As expected, equipment sales reflected some delayed customer demand ahead of the launch of the Company’s newest video gaming cabinet, the Dynasty Vue.

2023 First Quarter Financial Technology Solutions (FinTech) Segment Highlights

FinTech revenues for the 2023 first quarter increased 20% to $93.1 million compared to $77.3 million in the first quarter of 2022, reflecting 13% growth in financial access services, a 35% gain in software and other revenues, and a 34% increase in hardware sales. Organic growth was 16% and acquisitions completed in 2022 contributed $3.6 million in revenues year over year, or 4% growth.

Operating income increased 20% to $29.8 million compared to $24.8 million in the prior-year period, reflecting higher revenues partially offset by higher depreciation and amortization related to recent acquisitions and increased research and development expense for new and enhanced products. Adjusted EBITDA rose 14% to $38.8 million compared to $34.1 million in the 2022 first quarter.

- Financial access services revenues, which include cashless and cash-dispensing debit and credit card transactions and check services, increased 13% to $56.2 million compared with the 2022 first quarter, reflecting higher same-store financial funding transactions, as well as continued growth from new customer additions. Funds delivered to casino floors increased 14% to an all-time quarterly record of $11.5 billion on a 13% increase in the number of financial transactions and an increase in average transaction size. Cashless transactions (including both digital wallet and paper gaming voucher transactions) increased 46% over the 2022 first quarter and 21% on a quarterly sequential basis, while still representing less than 5% of funding transactions. The company’s CashClub Wallet technology is currently deployed at or being deployed across 22 jurisdictions at 43 casinos.

- Software and other revenues, which include Loyalty and RegTech software, product subscriptions, kiosk maintenance services, and other revenues, rose 35% to $24.2 million in the first quarter of 2023 compared to $17.9 million in the first quarter of 2022. Approximately 72% and 80% of software and other revenues were of a recurring nature in the 2023 and 2022 first quarter periods, respectively.

- Hardware sales revenues increased 34% to $12.7 million compared to $9.5 million in the first quarter of 2022, partially reflecting the incremental revenues from a full-quarter contribution from the acquisition of e-cash Holdings completed in the first quarter of 2022.

Balance Sheet, Liquidity and Cash Flow

- As of March 31, 2023, the company had $293.2 million of cash and cash equivalents compared with $293.4 million as of December 31, 2022. The Net Cash Position was $106.8 million compared with $89.2 million as of December 31, 2022.

- Total debt decreased to $986.5 million at March 31, 2023, from $992.5 million as of December 31, 2022, as the company paid $6.0 million on its secured term loan during the 2023 first quarter.

- Cash paid for interest, net of interest income, was $25.1 million in the 2023 first quarter compared with $14.4 million in the year-ago period, inclusive of the semi-annual payment of $10.0 million interest on the company’s unsecured 5% notes in each period. The increase in net interest paid was primarily due to the impact of rising interest rates. In addition to the company’s variable-rate term debt and notes outstanding, interest expense also includes the impact of rising rates on third-party commercial cash arrangements associated with certain of the company’s funding of financial access services. These fees were $4.3 million for the 2023 first quarter on a daily average balance of $317.0 million compared to $1.0 million on a daily average balance of $361.1 million for the 2022 first quarter.

- Everi’s Board of Directors authorized a new $180 million share repurchase program over 18 months, replacing the company’s previous $150 million program that had approximately $66 million of remaining availability and would have expired on November 4, 2023.

- On May 1, 2023, the company completed the acquisition of the assets of VKGS LLC (Video King), a privately-owned provider of integrated electronic bingo gaming tablets, video gaming content, instant win games, and systems for cash consideration of approximately $59 million, inclusive of estimated customary net working capital adjustments. The acquisition, which will include the majority of Video King’s assets, was funded from existing cash on hand and is expected to be immediately additive to the company’s Adjusted EBITDA and free cash flow.