by Andrew Klebanow

The past fifteen months have challenged Indian casino operators in ways that were unimaginable two years ago. The initial lockdown and the rapid development of health and safety protocols, which in turn led to dramatic changes in operational procedures and marketing strategies, forced casino managers to focus on their core businesses, and forego long-term planning. Every operator’s focus over the past fifteen months has been on protecting their employees, customers, tribal community and core businesses. Scanning the environment for potential opportunities and threats became a tertiary activity.

As the nation slowly emerges from the dark days of the pandemic and casinos are allowed to gradually remove limits on patron occupancy and re-open non-core enterprises, it may be time to look at emerging trends that may have gone unnoticed during this past year. These represent both opportunities and threats to Indian casinos.

Historic Horse Racing Machines

Any tribe whose casino operates in a jurisdiction with or adjacent to a jurisdiction with pari-mutuel wagering or live racing needs to understand the evolution of historic horse racing (HHR) machines, and the competitive threat they may pose.

HHR machines are electronic gaming devices, nearly identical in appearance to Class II and Class III gaming devices whose game math is predicated on the results of past horse races. The first versions of these machines were developed by AmTote International, a leading developer of pari-mutuel wagering systems. Early versions of these electronic gaming devices employed two displays: the primary display depicted spinning reels and a small secondary video display. When the player placed a wager, the large screen would display spinning reels and the smaller screen would activate a video of horses crossing a finish line. It was the results of that race, which occurred sometime in the past, that determined the stopping points of the spinning reels. Early versions of these machines required players to hit two buttons: an auto-handicap button and a second button to initiate game play. There were also a limited number of game titles that were available. Nonetheless, HHR machines provided quality electronic gaming entertainment and were successful in markets where there were no other options.

HHR machines have evolved dramatically in the past three years. In 2018, Ainsworth Game Technology developed a new cabinet and HHR system that dramatically narrowed the difference between a Class III slot machine and an HHR machine. These games were housed in the newest generation of game cabinets. These new machines also eliminated the need to press two buttons. Rather than employing a second video screen, when a player hit the wager button, the main screen displayed spinning reels while the top box of the game cabinet, used to display the game title, changed slightly to display a facsimile of horses racing across the cabinet. It was almost undetectable to the eye and did not distract a player’s attention from the main screen. Game speed was also faster. The company was able to adapt almost 100 of its most popular game titles to this new platform. In September of 2018, 900 of these new games were deployed at Churchill Downs’ Derby City Gaming in Louisville, KY, and they have proven to be very popular. The machines were subsequently introduced at other Churchill Downs facilities in Kentucky.

In the last 16 months, Ainsworth has entered into licensing agreements with several leading game manufacturers whereby their games will operate on Ainsworth’s HHR system. In other words, a large library of the world’s most popular game titles will now be available on HHR cabinets.

The emergence of HHR machines has not gone unnoticed by Indian casino operators. The 2021 gaming compact between the Seminole Tribe of Florida and the State of Florida includes the following language that severely restricts the kinds of HHR machines that may be permitted at the state’s pari-mutuel facilities:

“The display of the video of the horse or greyhound race must occupy at least seventy percent of the Historic Racing Machine’s video screen and no Historic Racing Machine may contain or be linked to more than one video display.”

“No casino game graphics, themes or titles, including but not limited to depictions of slot machine-style symbols, cards, dice, craps, roulette, lotto, or bingo may be used.”

“No video or mechanical reel displays are permitted.”

Clearly, the Seminole Tribe of Florida recognized that a state with thirty pari-mutuel wagering facilities could one day pose a threat to its core businesses should they be allowed to introduce modern HHR games. Indian casino operators need to scan the environment and identify pari-mutuel facilities that could one day install these games. These products are very competitive and could cannibalize core markets.

The Growth of Class III Online Slot Machines and Table Games

Despite the pandemic, virtually every Indian casino operator has been visited by multiple salespeople representing sports betting operators and social gaming providers, eager to secure market share in these rapidly growing industries. Even though tribes in many jurisdictions still require the re-opening of compact negotiations before any form of sports betting can be offered, sports betting vendors have been eager to promote their brands and secure agreements.

What may have gone unnoticed by Indian casino operators is the dramatic growth of Class III online table game and slot wagering. Several states including New Jersey, Delaware, Michigan, and Pennsylvania offer online casinos with real money wagering on slot machines and table games.

One would have expected that these online operations to enjoy revenue growth during last year’s lockdown. What was unexpected was the continued growth of online wagering after casinos re-opened, and absence of cannibalization from casino brick-and-mortar operations.

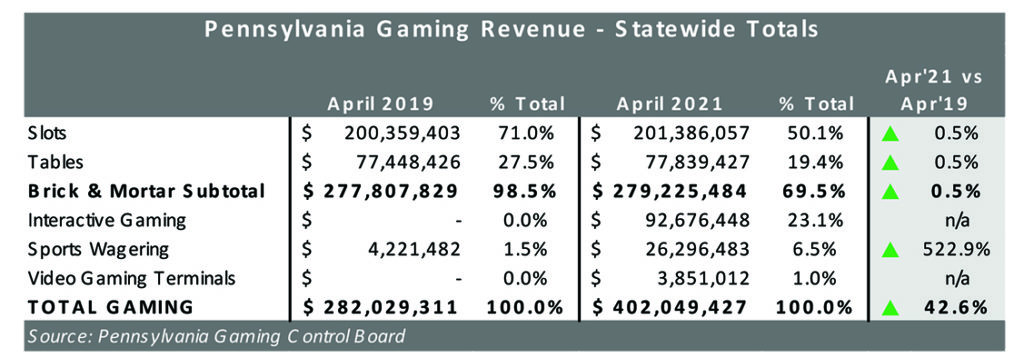

The gaming revenue report from April 2021 issued by the State of Pennsylvania illustrates these trends. The table above compares gaming revenues for April 2019 to April 2021 for brick-and-mortar gaming, interactive (online) gaming, sports wagering and video gaming terminals at truck stops.

In April of 2021, Pennsylvania generated $279.2 million in casino revenue at the state’s licensed casinos and racetracks, a modest improvement of 0.5% from April of 2019, despite limits on capacity, the absence of non-gaming amenities, and the continued prohibition of indoor smoking.

Interactive gaming (online wagering on slots and table games) generated $92.7 million in April of 2021, making up 23% of the state’s total take. Clearly in Pennsylvania, there is a new product that is capturing the interest of the gaming public, and it is not cannibalizing gaming revenues from the state’s brick-and-mortar casinos.

What Pennsylvania illustrates is an emerging trend and an opportunity for tribes seeking complementary businesses for their traditional casino operations. Real money, Class III online wagering is growing. It is gaining acceptance from a portion of the population, and it is not negatively impacting land-based operations. Land-based casinos are not going away. As mask mandates are eliminated and social distancing limits are reduced, a growing portion of the population feels safe going out and enjoying casino entertainment again. This is evident across the country. What is also evident is that online wagering is growing and needs to be included in long-term business plans.

The pandemic forced operators to focus on their core businesses, keep employees, customers and their tribal communities safe, and deal with a wealth of operational challenges. As the industry recovers, it is now time to pay attention once again to emerging trends that may impact business in the future.

Andrew Klebanow is a Principal at Klebanow Consulting and has worked in the casino industry since 1977 and as a gaming consultant since 2000. He can be reached by calling (702) 845-7346 or email andrew@klebanowconsulting.com.