by James M. Klas

In looking at casino performance, it is common to deal with averages. Average win per machine, average win per square foot, average win per visit, operating margins, EBITDA, and other measures. However, experienced operators know that there is a subset of the customer base that is anything but average. The standard deviation for revenue per customer per visit for gaming is quite large, unlike nearly all other businesses dependent upon direct customer interaction in large numbers. A small number of key customers, sometimes referred to as “whales” in the old casino vernacular, generate a disproportionately large amount of gaming revenue.

In case it was not clear before, it is now obvious that the pandemic will last through the first quarter of next year, even with the most optimistic vaccine timetables. That means capacity restrictions, reduced amenities and other constraints will last until then as well, at least to some degree. The quickest and most effective way in the short-term to compensate for reduced capacity on the gaming floor is to maximize the number of visits and average spend of top tier customers. By doing so, reductions in capacity by 50 percent or more due to the pandemic do not have to automatically mean a reduction in revenue by 50 percent.

Observations of players’ club data from Indian casinos throughout the U.S. show just how valuable top tier players can be to a casino, even without pandemic driven space limitations. The top 20 percent of players’ club members at Indian casinos generate an average of nearly 56 percent of total gaming revenue. Mathematically, this makes the average player in the top 20 percent worth more than five times as much as the average players in the lower 80 percent range. The greater revenue impact is a function of both more frequent visits and higher expenditures per visit. Players in the top 20 percent tend to visit more than twice as frequently as the average patron and they tend to spend over 28 percent more than the rest of the customers each time they visit.

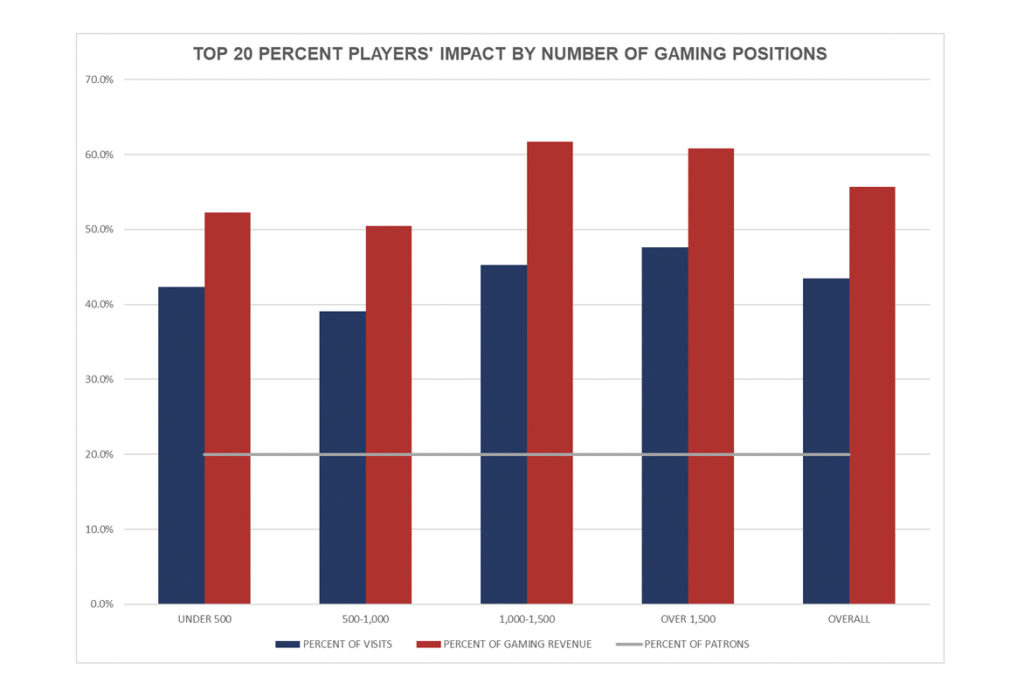

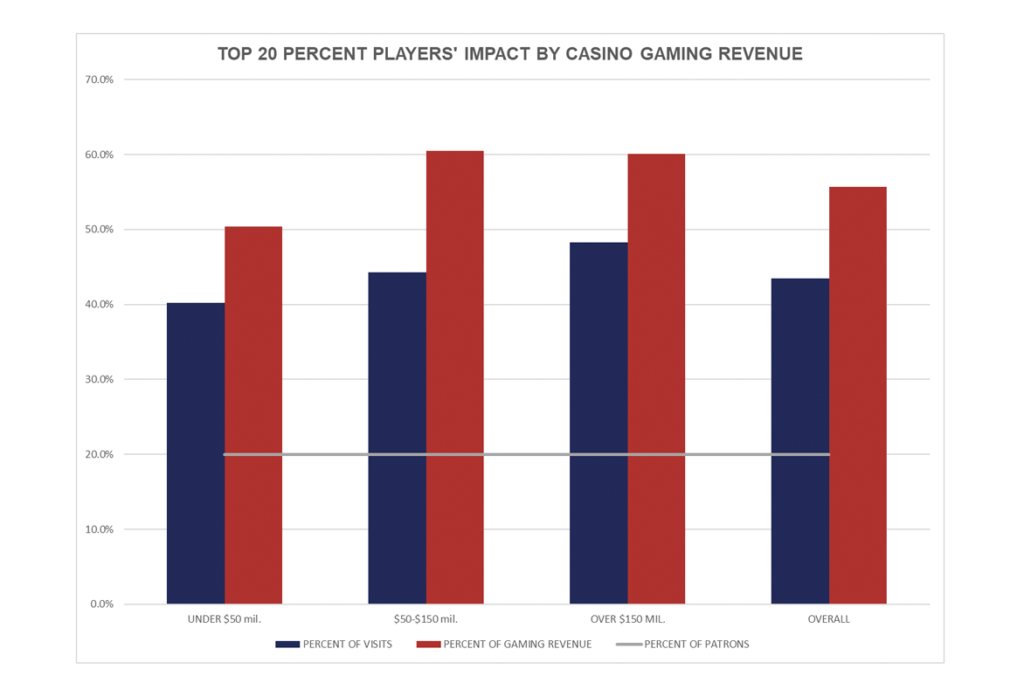

There is a range in performance impacts for high-value patrons across Indian Country depending upon the size of the facility and the size of its players’ club. In general, the larger the casino and/or the larger the players’ club, the greater the impact of the top 20 percent on total gaming revenue. However, the impact of the top 20 percent for the very largest casinos is actually slightly lower than for casinos not quite as large. Figures 1, 2 and 3 provide summaries of gaming revenue impact from the top 20 percent of players’ club members sorted by various measures of facility and club size.

Age also plays a role in the impact of high-value players. Even within the top 20 percent of all players’ club members, younger players tend to generate less impact than older players. Figure 4 shows the same measures of percentage of visits and gaming win for the top 20 percent overall segmented by age bracket. Those under 45 years old visit less often and spend less per visit than other top 20 percent players’ club members. Those in the 45 to 65 age range visit only slightly more often than their top 20 percent peers, but spend significantly more, making them the most valuable overall age segment. Those age 65 and older visit the most often relative to their proportion within the top 20, but only spend slightly more than the top 20 average.

Given the magnitude of the impact of high-value gamers, the importance of maintaining the closest possible contact with your top customers is clear, making sure that they have every incentive to continue to visit and every reassurance that you will make them as safe as possible. In particular, given health and safety concerns, as well as personal comfort in the PPE era, private gaming areas and private gaming events for top players will be a useful tool to reward them, not only with prestige, but also with increased safety. The traditional “high limit” areas, open to any who want to meet the minimums, are not the same thing. Private gaming areas and private events would be more segregated from the gaming floor, open by invitation only, and with significantly enhanced seating, spacing and food and beverage service. Gaming concierges could meet high value gamers that have made advance arrangements, or respond to those that arrive unexpectedly, and guide them to their preferred game while arranging food service and anything else they need.

An offshoot of the private gaming for high value gamers could also be reserved private gaming areas for anyone willing to pay a premium or guarantee a minimum theoretical for their group. Again, they could know that the area is separate from the main floor, cleaned directly before and after their group, and served by dedicated staff with enhanced food and beverage offerings. Fees could be charged to rent the private space and then waived or refunded for meeting a minimum spend. The basic concept is like a luxury box at a stadium or a private room at a nightclub.

In addition, frequent, direct communication by hosts, general managers and favorite floor personnel on a person-to-person basis is needed. While such communication can include offers and incentives, it should also include general inquiries about the customer’s welfare, health, any personal needs and anything the casino can do to make their lives easier. Regular, personal communication can also provide early warning of any problems, new ideas to appeal to the top tier segment and more nuanced insights into their behavior than simply tracking their players’ club statistics. A sense on the part of your top tier customers that you are actively listening and responding to their concerns will greatly enhance their perception of safety and control. Most of your top tier customers are in age groups that are more vulnerable to the virus. Their perception of safety, or lack thereof, will directly affect the frequency of their visits and time on the gaming floor. If they have a competitive choice within reasonable driving distance, being the casino that is most attentive to their needs will drive them to choose you over the competition.

Almost any significant step that casino management can take to preserve performance levels and recover more quickly takes time and often dollars. Focusing on top tier customers and taking targeted steps to meet their concerns first and foremost can be done immediately and have the greatest benefit for gaming revenue while the pandemic runs its course.

James M. Klas is Co-Founder and Principal of KlasRobinson Q.E.D., a national consulting firm specializing in the economic impact and feasibility of casinos, hotels and other related ancillary developments in Indian Country. He can be reached by calling (800) 475-8140 or email jklas@klasrobinsonqed.com.