UNCASVILLE, CT – Mohegan Tribal Gaming Authority has announced operating results for its first fiscal quarter ended December 31, 2025.

First Quarter 2026 and Recent Highlights:

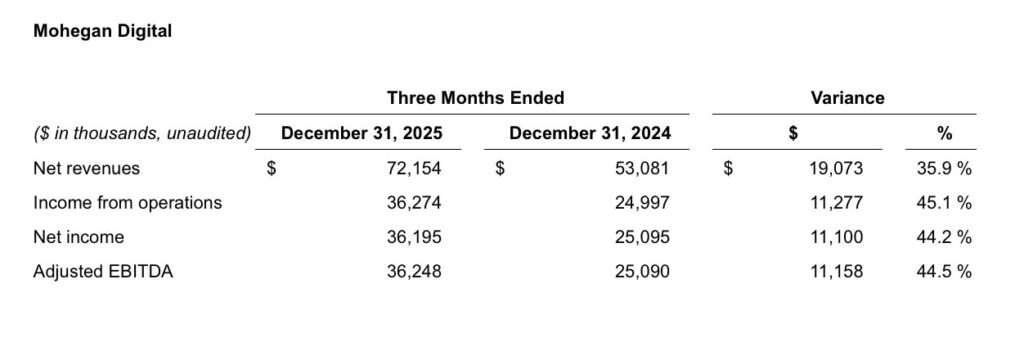

Mohegan Sun generated its highest first-quarter net slot win since fiscal year 2018. Mohegan Digital reported its highest-ever quarterly net revenues and Adjusted EBITDA, with monthly active users reaching an all-time high. Mohegan Digital’s Adjusted EBITDA increased 44.5% year over year.

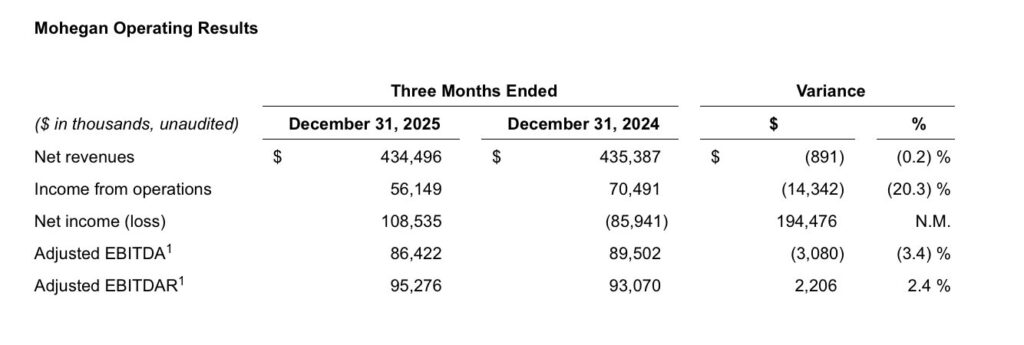

“Adjusted EBITDAR of $95.3 million increased 2.4% on flat net revenues. Results were largely driven by Mohegan Digital delivering its strongest quarterly performance to date,” said Ari Glazer, CFO of Mohegan. “Adjusted EBITDA of $86.4 million decreased $3.1 million, as the prior year comparable period benefitted from favorable table hold at Mohegan Sun and a one-time property tax adjustment at Niagara Resorts. After normalizing for these factors, Adjusted EBITDA would have been up $4.8 million, or 5.9%.”

Prior period amounts have been restated to exclude results of operations of Inspire Integrated Resort Co., Ltd., its parent company MGE Korea Limited, and certain affected subsidiaries, from continuing operations.

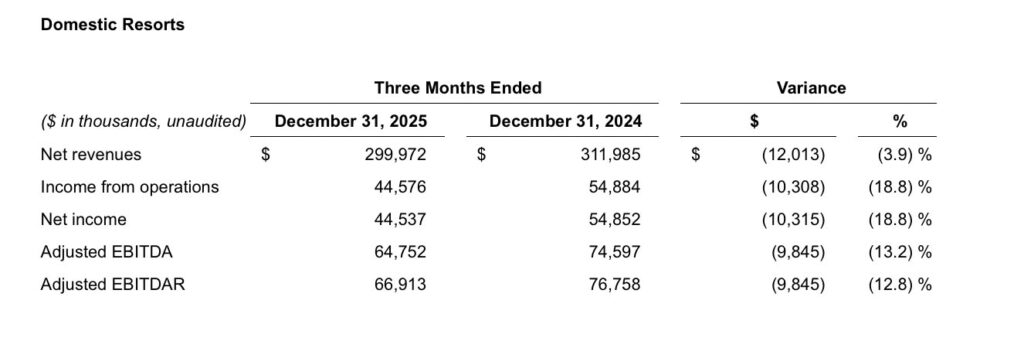

Net revenues of $300 million decreased $12 million compared with the prior-year period. Entertainment revenues declined as a result of fewer arena events in the current period, while the prior-year comparable period benefited from favorable table hold at Mohegan Sun and $6.6 million of net revenues from Las Vegas operations. Adjusted EBITDA of $64.8 million decreased $9.8 million compared with the prior-year period, factoring in the previously described items.

Net revenues of $72.2 million increased $19.1 million compared with the prior-year period. Adjusted EBITDA of $36.2 million increased $11.2 million compared with the prior year period. Mohegan Digital generated its highest ever quarterly net revenues and Adjusted EBITDA, as their Connecticut operations achieved their strongest performance to date. Their Pennsylvania and Ontario operations also produced their highest quarterly net revenues to date.

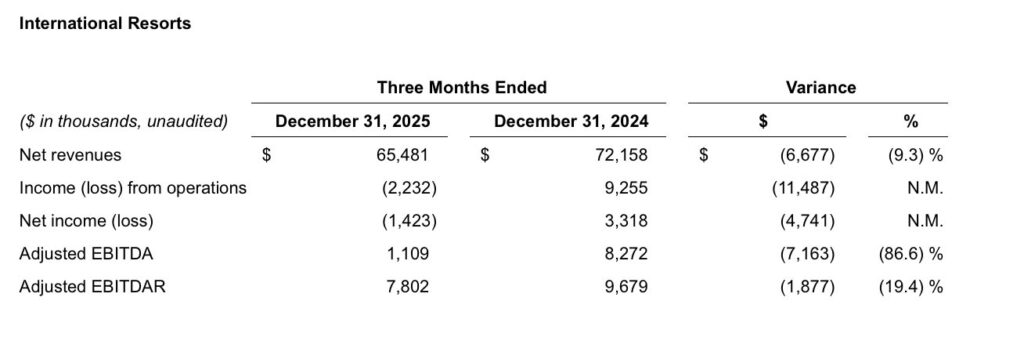

Net revenues of $65.5 million decreased $6.7 million compared with the prior-year period. Adjusted EBITDA of $1.1 million decreased $7.2 million compared with the prior-year period. The decline in net revenues is primarily attributed to lower gaming volumes compared with the prior-year period. Adjusted EBITDA in the comparable prior-year period benefited from a favorable one-time property tax adjustment.

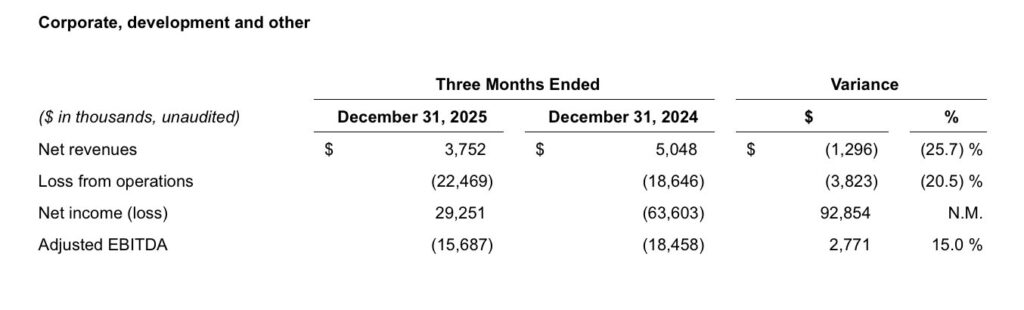

Net revenues of $3.8 million decreased $1.3 million compared with the prior-year period. Adjusted EBITDA loss of $15.7 million was $2.8 million favorable compared with the prior-year period. The increase in Adjusted EBITDA is primarily attributed to labor savings in the current period related to their recent workforce reduction. Net income in the current-year period includes a $102 million non-cash gain from discontinued operations related to derecognized Mohegan INSPIRE guarantee liabilities.

Liquidity

As of December 31, 2025 and September 30, 2025, Mohegan held cash and cash equivalents of $154 million and $128 million, respectively. Inclusive of letters of credit which reduce borrowing availability, Mohegan had $146.8 million of borrowing capacity under its senior secured credit facility and line of credit as of December 31, 2025. In addition, inclusive of letters of credit which reduce borrowing availability, Niagara Resorts had $36.5 million of borrowing capacity under its revolving credit and swingline facility as of December 31, 2025.