UNCASVILLE, CT – Mohegan Tribal Gaming Authority has released operating results for its fourth quarter and full fiscal year ended September 30, 2025.

Fourth Quarter 2025 and Recent Highlights:

- Mohegan generated net revenues of $453.0 million.

- Mohegan Sun produced net revenues of $260.1 million.

- Mohegan Digital net revenues up 40.3% year over year.

- Mohegan Digital Adjusted EBITDA increased 28.6% year over year.

“In fiscal year 2025, our core properties and digital operations grew net revenues 6.0% year over year on a consolidated same-store basis. Mohegan Digital was the primary catalyst, with net revenues growing 48.5% year over year,” said Raymond Pineault, Chief Executive Officer of Mohegan.

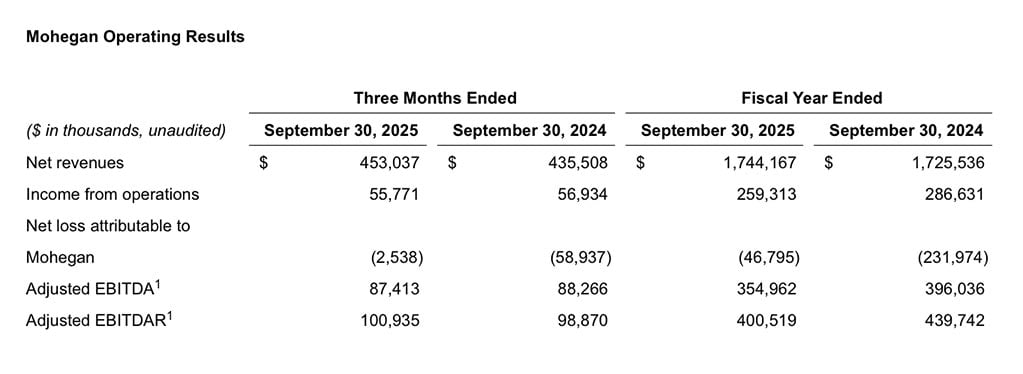

Fourth Quarter 2025

“Net revenues of $453.0 million increased $17.5 million compared with the prior-year period, driven by 40.3% year over year growth from Mohegan Digital,” said Ari Glazer, CFO of Mohegan. “Consolidated Adjusted EBITDA of $87.4 million decreased 1.0% compared with the prior-year period, as the prior year benefited from ilani management fees and Las Vegas operations, but was negatively impacted by a higher non-cash adjustment to the value of a customer contract asset at Niagara Resorts.”

Full Fiscal Year 2025

“Net revenues of $1.7 billion increased $18.6 million compared with the prior-year period, driven by 48.5% year over year growth from Mohegan Digital,” said Glazer. “Consolidated Adjusted EBITDA of $355.0 million decreased $41.1 million compared with the prior-year period, as the prior year benefitted from non-cash digital license fee revenue at Mohegan Pennsylvania, ilani management fees, and Las Vegas operations, but was negatively impacted by a higher non-cash adjustment to the value of a customer contract asset at Niagara Resorts. After normalizing the prior-year period for the Mohegan Pennsylvania, ilani, Las Vegas, and Niagara Resorts adjustments, Adjusted EBITDA would have been up $6.2 million, or 1.8%.”

Prior period amounts have been restated to exclude results of operations of Inspire Integrated Resort Co., Ltd., its parent company MGE Korea Limited, and certain affected subsidiaries from continuing operations.

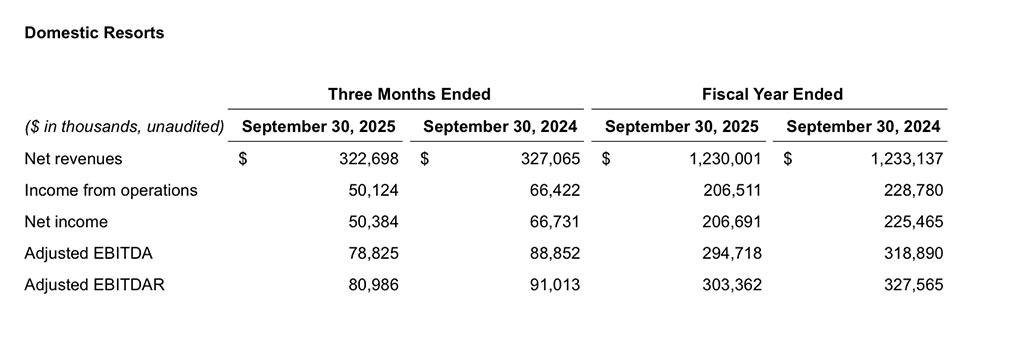

Fourth Quarter 2025

Net revenues of $322.7 million decreased $4.4 million compared with the prior-year period. Adjusted EBITDA of $78.8 million decreased $10.0 million. The decreases are primarily attributed to lower table hold at Mohegan Sun compared with prior-year period, and the inclusion of Las Vegas operations in the prior year comparable period.

Full Fiscal Year 2025

Net revenues of $1.2 billion decreased $3.1 million compared with the prior-year period. Adjusted EBITDA of $294.7 million decreased $24.2 million. The prior year comparable period includes Las Vegas operations and benefited from non-cash digital license fee revenue at Mohegan Pennsylvania.

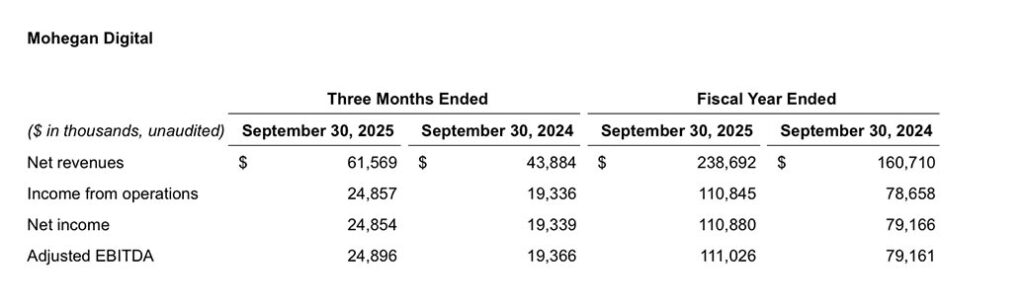

Fourth Quarter 2025

Net revenues of $61.6 million increased $17.7 million compared with the prior-year period. Adjusted EBITDA of $24.9 million was $5.5 million favorable compared with the prior-year period.

Full Fiscal Year 2025

Net revenues of $238.7 million increased $78.0 million compared with the prior-year period. Adjusted EBITDA of $111.0 million was $31.9 million favorable compared with the prior-year period.

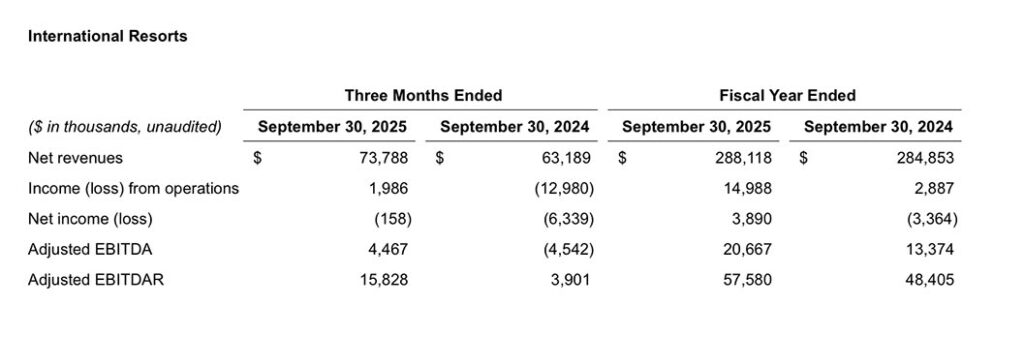

Fourth Quarter 2025

Net revenues of $73.8 million increased $10.6 million compared with the prior-year period. Adjusted EBITDA of $4.5 million increased $9.0 million compared with the prior-year period. The prior year comparable period includes an unfavorable non-cash adjustment to the value of a customer contract asset at Niagara Resorts.

Full Fiscal Year 2025

Net revenues of $288.1 million increased $3.3 million compared with the prior-year period. Adjusted EBITDA of $20.7 million increased $7.3 million compared with the prior-year period. The prior year comparable period includes an unfavorable non-cash adjustment to the value of a customer contract asset at Niagara Resorts.

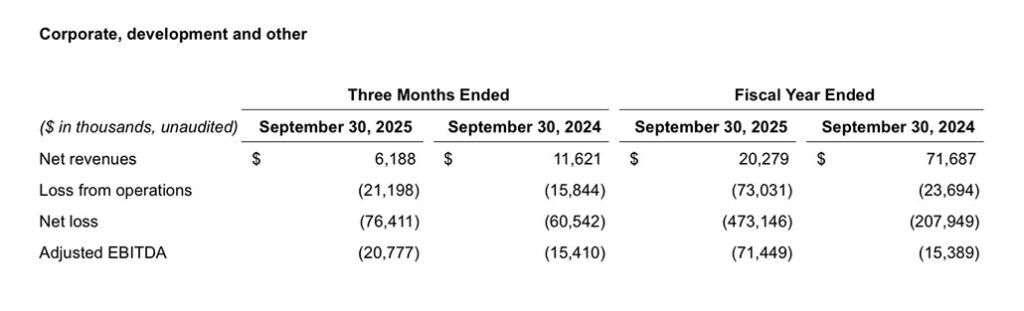

Fourth Quarter 2025

Net revenues of $6.2 million decreased $5.4 million compared with the prior-year period. Adjusted EBITDA loss of $20.8 million was $5.4 million unfavorable compared with the prior-year period. The decreases are primarily attributed to the prior-year period benefiting from ilani management fees and increased professional fees in the current-year period.

Full Fiscal Year 2025

Net revenues of $20.3 million decreased $51.4 million compared with the prior-year period. Adjusted EBITDA of $71.4 million was $56.1 million unfavorable compared with the prior-year period. The decreases are primarily attributed to the prior-year period benefiting from ilani management fees and increased professional fees in the current-year period.

Liquidity

As of September 30, 2025 and September 30, 2024, Mohegan held cash and cash equivalents of $128.0 million and $145.7 million, respectively. Inclusive of letters of credit, which reduce borrowing availability, Mohegan had $198.6 million of borrowing capacity under its senior secured credit facility and line of credit as of September 30, 2025. In addition, inclusive of letters of credit which reduce borrowing availability, Niagara Resorts had $35.9 million of borrowing capacity under its revolving credit and swingline facility as of September 30, 2025.